Trading Volume and Value Highlight Market Enthusiasm

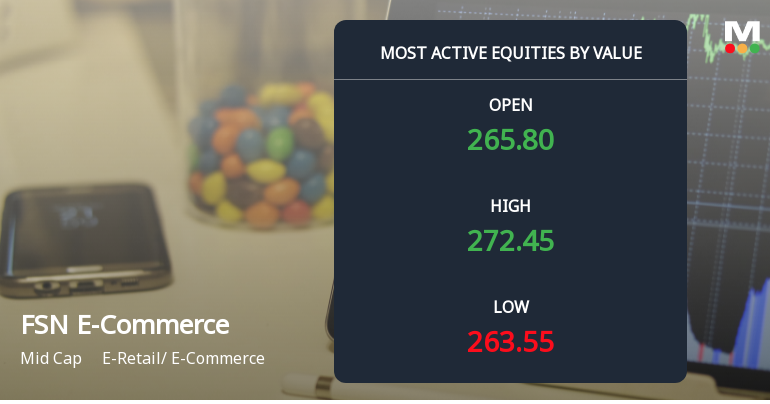

On 6 February 2026, FSN E-Commerce Ventures Ltd recorded a total traded volume of 1.39 crore shares, translating into a substantial traded value of ₹375.16 crore. This level of activity places the stock among the highest value turnover equities on the exchange, underscoring its liquidity and appeal to both retail and institutional investors. The stock opened at ₹264.80, marking a 2.52% gap up from the previous close of ₹258.29, and reached an intraday high of ₹271.80, a 5.23% gain from the open. The last traded price stood at ₹267.92 as of 09:45 IST, maintaining a strong position close to its 52-week high of ₹273.22, just 2.14% away.

Price Momentum and Moving Averages Signal Strength

FSN E-Commerce Ventures Ltd has been on a consistent upward trajectory, gaining for four consecutive days and delivering a cumulative return of 12.57% over this period. The stock’s performance notably outpaced its sector, which declined by 0.45% on the same day, and the Sensex, which fell by 0.41%. The price currently trades above all key moving averages — 5-day, 20-day, 50-day, 100-day, and 200-day — indicating a robust bullish trend and strong technical support. This alignment of moving averages often attracts momentum traders and institutional buyers, further reinforcing the stock’s upward momentum.

Institutional Interest Evident in Delivery Volumes

Investor participation has intensified, as evidenced by the delivery volume of 48.78 lakh shares on 5 February 2026, which surged by 55.41% compared to the five-day average delivery volume. This increase in delivery volume suggests that investors are not merely trading intraday but are holding positions, signalling confidence in the company’s medium to long-term prospects. The stock’s liquidity is also noteworthy, with the capacity to handle trade sizes of approximately ₹3.03 crore based on 2% of the five-day average traded value, making it an attractive option for large institutional trades without significant market impact.

Mojo Score and Rating Update Reflect Cautious Optimism

MarketsMOJO assigns FSN E-Commerce Ventures Ltd a Mojo Score of 68.0, categorising it with a Hold grade as of 4 February 2026, a downgrade from its previous Buy rating. This adjustment reflects a more cautious stance amid evolving market conditions and valuation considerations. The company’s market capitalisation stands at ₹76,691.39 crore, placing it firmly in the mid-cap segment. Despite the downgrade, the stock’s fundamentals remain solid, supported by its leadership in the e-retail and e-commerce sector and consistent revenue growth.

Sectoral Context and Comparative Performance

The e-commerce sector has faced mixed sentiments recently, with concerns over valuation pressures and competitive dynamics. However, FSN E-Commerce Ventures Ltd’s ability to outperform its sector by 3.82% on the day highlights its relative strength and investor preference. The company’s proximity to its 52-week high and sustained volume growth indicate that it remains a preferred pick within the sector, benefiting from strong brand recognition and expanding market share.

Order Flow and Institutional Activity

Large order flows have been a defining feature of FSN E-Commerce Ventures Ltd’s recent trading sessions. The surge in delivery volumes and high traded value suggest active participation from institutional investors, who typically seek stocks with strong liquidity and growth potential. This institutional interest often acts as a catalyst for further price appreciation, as it signals confidence from professional money managers and funds. The stock’s ability to absorb sizeable trades without significant price disruption enhances its attractiveness for portfolio managers looking to build or increase positions.

Outlook and Investor Considerations

While the recent price action and volume trends are encouraging, investors should weigh the recent downgrade in rating and the stock’s valuation metrics carefully. The Hold grade from MarketsMOJO suggests that while the stock remains fundamentally sound, upside may be limited in the near term without further catalysts. Investors should monitor quarterly earnings, sector developments, and broader market conditions to assess the sustainability of the current momentum. Given the stock’s liquidity and institutional interest, it remains a viable option for investors seeking exposure to the growing e-commerce space with a balanced risk-reward profile.

Conclusion: A Stock Under the Spotlight

FSN E-Commerce Ventures Ltd’s recent trading activity underscores its position as a key player in the Indian e-commerce landscape. The combination of high value turnover, strong institutional interest, and positive price momentum highlights the stock’s appeal to a broad investor base. While the recent rating downgrade advises caution, the company’s market leadership and liquidity profile make it a noteworthy contender for investors seeking exposure to the sector. Continued monitoring of trading volumes, price action, and fundamental developments will be essential to gauge the stock’s trajectory in the coming months.

Unlock special upgrade rates for a limited period. Start Saving Now →