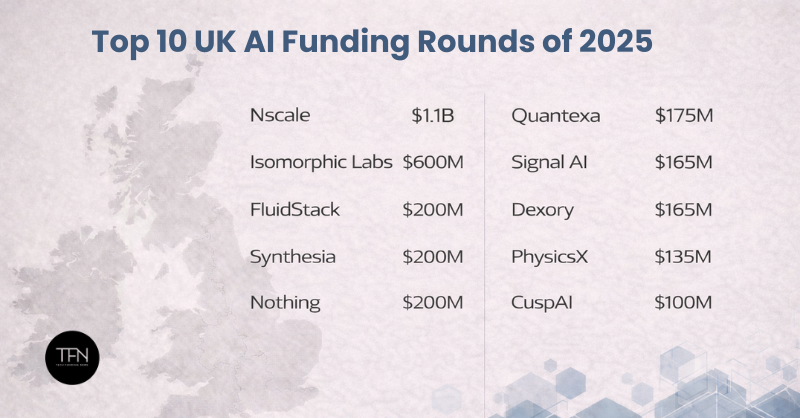

The UK’s AI sector continued its remarkable growth in 2025. Venture capital data from DWF Group shows AI startups dominated investment in 2025, securing £1.8 billion in funding in the first half of the year, highlighting both the volume and strategic importance of AI deals in the broader UK VC landscape.

This surge reflects the UK’s innovation hubs, strong research base, and supportive ecosystem, making 2025 a standout year for AI funding.

In this roundup, we highlight the top 10 UK AI funding rounds of 2025, showcasing deals that are shaping the future of technology and positioning the UK at the forefront of global AI investment.

Nscale

Founder/s: Josh Payne

Founded year: 2023

Recent funding: $1.1B

Nscale is an AI-optimised infrastructure platform designed to support the next wave of technological innovation. Its vertically integrated model spans hardware procurement, drawing on one of the world’s largest GPU supply pipelines, through to a proprietary software orchestration layer that delivers highly efficient, fine-tuned performance.

The company operates greenfield data centres in Norway and the UK, powered by ultra-low-cost renewable hydroelectric energy, enabling low-latency, sovereign-ready compute at significantly lower costs than traditional hyperscalers.

Making history, Nscale closed the largest Series B round in European history in September, securing $1.1 billion. Led by energy titan Aker ASA and supported by industry leaders including Microsoft, OpenAI, NVIDIA, Dell, Fidelity Management & Research, G Squared, Nokia, Point72, Blue Owl, and T.Capital, this round enables the company to accelerate the global rollout of its AI-native infrastructure.

Isomorphic Labs

Founder/s: Demis Hassabis

Founded year: 2021

Recent funding: $600M

Isomorphic Labs is an AI-driven drug discovery company spun out of Alphabet’s DeepMind, focused on applying advanced artificial intelligence to pharmaceutical research.

Building on DeepMind’s AlphaFold technology, the company predicts protein structures in the human body, enabling scientists to understand disease mechanisms better and design more precise, effective drugs. Isomorphic works closely with major pharmaceutical partners to accelerate drug development and improve the efficiency of bringing new therapies to market.

The company recently secured $600 million in funding, underlining strong investor confidence in AI applications beyond large language models. The capital will support long-term growth in AI-powered drug design, a field expected to expand rapidly alongside medical innovation and supportive policies such as the UK’s Life Sciences Plan.

Nothing

Founder/s: Carl Pei

Founded year: 2021

Recent funding: $200M

Consumer electronics startup Nothing quickly garnered attention in the fierce smartphone market, thanks to its standout design. Its transparent aesthetic, glowing LED back panels, and distinctive interface have helped the brand create a niche identity among younger consumers. The recently launched Phone (3) exemplifies this strategy, with critics and users alike praising its striking design and user-friendly features.

While the company surpassed $1 billion in total sales this year, it also raised $200 million in a Series C round led by Tiger Global in September. Existing backers GV, Highland Europe, EQT, Latitude, I2BF, and Tapestry joined the round, alongside new strategic investors Qualcomm Ventures and Zerodha co-founder Nikhil Kamath.

FluidStack

Founder/s: Gary Wu, Cesar Maklary

Founded year: 2017

Recent funding: $200M

Fluidstack, a cloud infrastructure provider, focuses on delivering high-performance computing for AI and machine learning workloads. The company specialises in supplying on-demand access to large-scale GPU clusters, enabling organisations to train advanced AI models and run inference efficiently.

By offering flexible, scalable infrastructure, Fluidstack eliminates the need for customers to invest heavily in hardware or manage complex systems. Its platform is used by AI research labs, fast-growing startups, and enterprise customers building and deploying data-intensive AI applications across multiple industries.

In February, Fluidstack secured a $200 million in a Series A funding round. The investment was led by the private equity firm Cacti. Reportedly, the company is eyeing to raise $700 million, which could value it at around $7 billion.

Synthesia

Founder/s: Victor Riparbelli, Steffen Tjerrild, Prof. Lourdes Agapito, Prof. Matthias Niessner

Founded year: 2017

Recent funding: $200M

To drive change in corporate training and communication, Synthesia builds AI tools for corporations. It enables global corporations such as DuPont, Xerox, and Spirit Airlines to turn complex training materials into engaging, multilingual videos featuring realistic digital presenters. What began as an experiment in simplifying workplace content has quickly evolved into a significant business.

Having raised $200 million led by Alphabet’s venture firm, GV, Synthesia is now valued at $4 billion. With this latest funding, the company plans to expand its reach beyond the training room. It is building tools for marketing, advertising, and internal communications, aiming to provide a single integrated platform for all types of business video.

Ori Industries

Founder/s: Mahdi Yahya

Founded year: 2018

Recent funding: $175M

Ori Industries, a London-based AI infrastructure provider founded in 2018, operates a cloud computing platform delivering high-performance compute for artificial intelligence workloads. The company was established by Mahdi Yahya, an entrepreneur with over 20 years of experience building data centre networks and internet infrastructure globally.

Ori provides businesses with pay-as-you-go cloud-based access to high-performance GPUs for AI model training, inference, and deployment. The platform integrates Nvidia’s most advanced processors, including the H200, H100, and GB200 chips, which are available across European data centres.

Ori operates as the connective infrastructure layer between AI applications and physical compute hardware, addressing the European shortage of sovereign AI compute capacity. The company recorded $42 million in annual recurring revenue by Q1 2024, with projections to exceed $300 million by year-end, demonstrating strong demand for European-based AI compute infrastructure.

In February 2025, Ori secured $175 million in funding to scale its compute-as-a-service operations across Europe. The company also announced an undisclosed strategic investment from Saudi Aramco’s venture capital arm, which will enable expansion into the Middle East.

Quantexa

Founder/s: Vishal Marria

Founded year: 2016

Recent funding: $175M

Specialising in Digital Intelligence (DI) solutions, Quantexa announced a partnership with Microsoft. It launched an AI-powered workload for Microsoft Fabric and a cloud-native anti-money laundering (AML) solution for US mid-market banks via Azure Marketplace.

The company also announced Q Assist, an advanced AI-powered assistant designed to enhance and streamline analyst-led investigations. It allows users to interact with the platform in natural language, making investigations more efficient by providing a queryable, contextual representation of business risks and opportunities.

Earlier in 2025, Quantexa secured $175 million in Series F funding, pushing its valuation to $2.6 billion. The round was led by Teachers’ Venture Growth (TVG), part of the CAD 255 billion Ontario Teachers’ Pension Plan, with participation from existing investors, including British Patient Capital.

Signal AI

Founder/s: David Benigson, Miguel Martinez

Founded year: 2013

Recent funding: $165M

London-based Signal AI, which applies Artificial Intelligence to public information to identify risks and opportunities, comes to play. It helps companies that use media monitoring make better decisions and expand into new markets.

Signal AI reports that nearly 40% of Fortune 500 companies use its decision augmentation solution for real-time media and market intelligence to uncover risks, trends, and opportunities that support critical decision-making.

In September, Signal AI raised $165 million in growth equity led by Battery Ventures. Existing investors Highland Europe, Mercuri and MMC Ventures retain minority positions. Following this investment, Battery Ventures will acquire a majority stake in Signal AI and support the company through its next phase of growth.

PhysicsX

Founders: Robin Tuluie, Jacomo Corbo

Founded: 2019

Total funding: $135M

London-based PhysicsX is transforming industrial engineering by fusing generative AI with deep physics simulation, replacing traditional numerical modelling with AI-driven inference. The company’s enterprise platform uses Large Physics Models (LPMs) to enable engineers to run thousands of high-fidelity simulations per day, rather than waiting weeks for traditional computational results.

PhysicsX’s platform integrates seamlessly across the full product lifecycle, from concept through manufacturing to operational optimisation.

In June, PhysicsX closed a $135 million Series B funding round led by Atomico, with participation from industrial giants Siemens and Applied Materials, Singapore’s Temasek, and July Fund.

CuspAI

Founder/s: Max Welling, Chad Edwards

Founded year: 2024

Total funding: $100M

CuspAI is an AI startup that uses generative AI, deep learning, and molecular simulation to develop a platform for generating and evaluating new materials. The platform functions as a materials search engine, enabling users to request specific properties for new materials. CuspAI’s goal is to address sustainability challenges by developing materials that support climate action, renewable energy, and other global priorities.

After speculations, the UK-based deeptech startup pioneering AI-driven material discovery raised $100 million in its Series A round in September. The financing was co-led by New Enterprise Associates (NEA) and Singapore’s Temasek, with backing from NVentures (NVIDIA’s VC arm), Samsung Ventures, Hyundai Motor Group, and a strong roster of global investors. The round follows its $30 million seed just a year ago.

Dexory

Founder/s: Adrian Negoita, Andrei Danescu, and Oana Jinga

Founded: 2015

Recent funding: $165M

UK-based leader in warehouse robotics and AI-driven data intelligence, Dexory was initially founded as BotsAndUs. Its core mission is to transform logistics with autonomous robots and digital twin technology, enabling real-time operational visibility and smarter decision-making.

The flagship product, DexoryView, provides a real-time digital twin of warehouses by leveraging autonomous robots equipped with LiDAR and sensors to scan more than 10,000 locations per hour. It offers instantaneous insights, error detection, space optimisation, and safety monitoring, significantly improving inventory accuracy and operational efficiency.

In October, Dexory secured a $165 million Series C round led by Eurazeo’s Growth team, with participation from LTS Growth, Endeavor Catalyst, and existing investors such as DTCP, Atomico, Lakestar, Elaia, Latitude Ventures, and Wave-X. Additionally, Bootstrap Europe increased its growth debt facility by $65 million to support further expansion and product development.