Key global FinTech investment stats in Q1 – Q3 2025:

- Global FinTech funding dropped by 6% YoY

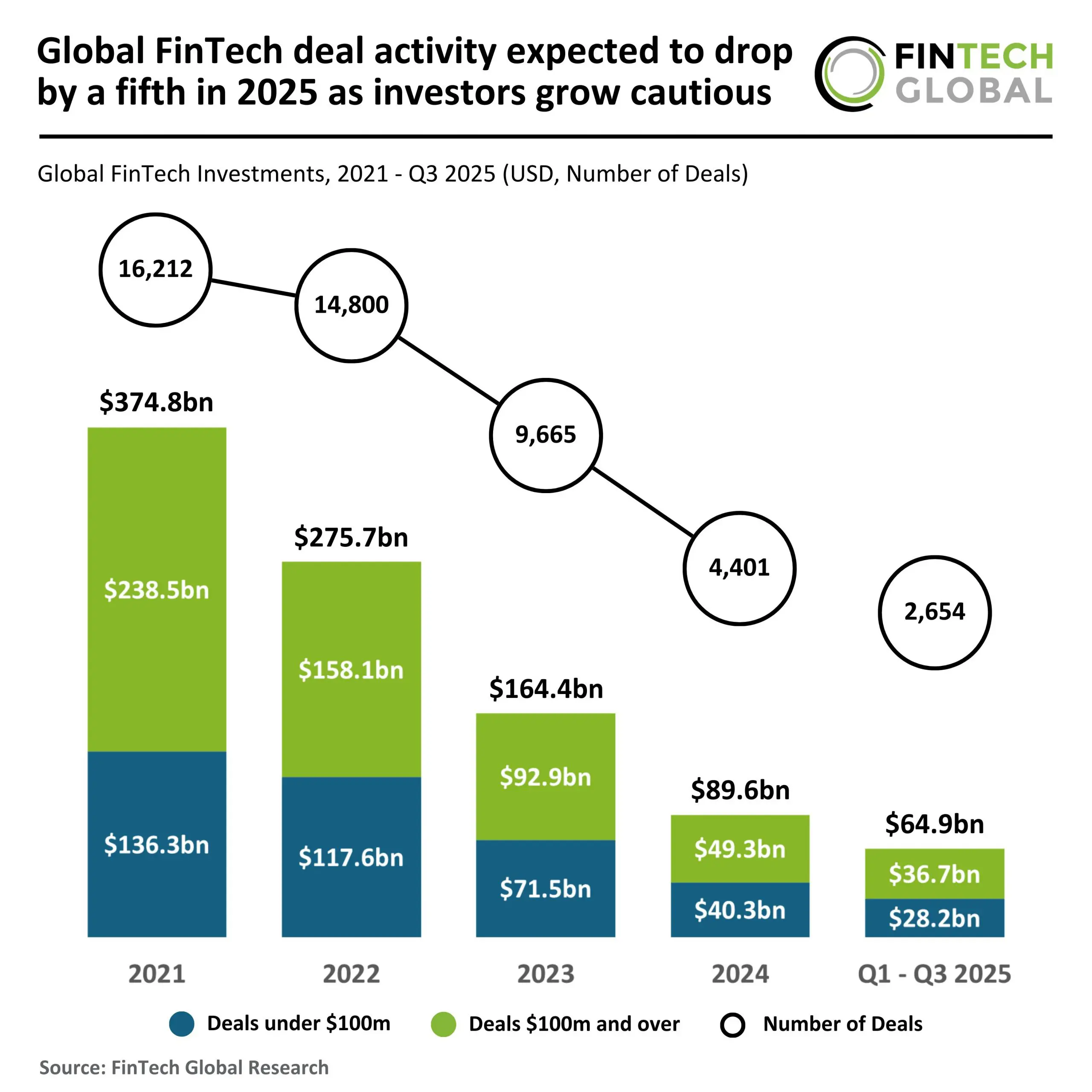

- At current investment pace, deal activity is projected to drop by a fifth in 2025

- Deals under $100m dropped by 15% as investors grew cautious

- Tide, the London-based business banking FinTech serving SMEs with integrated financial management and banking solutions, secured one of the biggest FinTech deals with a $120m strategic investment round

Global FinTech funding dropped by 6% YoY

In the first three quarters of 2025, the global FinTech market saw a moderation in overall activity compared with the same period in 2024.

Q1-Q3 2025 recorded 2,654 deals, a 27% decline from the 3,625 deals completed in Q1-Q3 2024.

Total funding over the same period fell to $64.9bn, a 6% drop from the $69.3bn raised a year earlier.

Despite the slowdown in deal volume, the average deal size increased notably, rising to $24.5m in Q1-Q3 2025 from $19.1m in Q1-Q3 2024.

This shift suggests that although fewer transactions are taking place, investors are concentrating more capital into larger individual rounds, favouring scale and maturity over breadth.

At current investment pace, deal activity is projected to drop by a fifth in 2025

If Q1-Q3 2025 performance were extended across the full year, total 2025 funding would reach $86.6bn with 3,539 deals.

This would represent a 3% decline in funding compared with the $89.7bn raised in 2024, while deal volume would fall more sharply by 20% from the 4,401 deals completed last year.

The projected average deal size for 2025 would therefore remain elevated, reinforcing the pattern of capital consolidation and signalling a maturing global FinTech investment landscape where later-stage and higher-value opportunities continue to command investor focus.

Deal size dynamics further illustrate this shift.

Deals under $100m dropped by 15% as investors grew cautious

In Q1-Q3 2025, deals under $100m totalled $28.2bn, a 15% decrease from the $33bn recorded in Q1-Q3 2024.

In contrast, deals of $100m or more edged up to $36.7bn, a 1% increase from the $36.3bn recorded a year earlier.

Using the 2025 projection methodology, full-year 2025 funding under $100m would reach $37.6bn, 7% below the $40.3bn seen in 2024.

Meanwhile, funding from deals above $100m would reach $49bn, broadly in line with the $49.3bn recorded in 2024.

These figures highlight a market where smaller transactions are contracting more noticeably, while large-scale rounds remain comparatively resilient, underpinned by continued appetite for established FinTech platforms and proven business models.

Tide, the London-based business banking FinTech serving SMEs with integrated financial management and banking solutions, secured one of the biggest FinTech deals with a $120m strategic investment round

Which was led by TPG at a post-money valuation of $1.5bn.

The round also saw continued support from existing backer Apax Partners through its Apax Digital Funds.

This latest funding more than doubles Tide’s 2021 valuation of $650m, officially cementing its status as a FinTech unicorn.

Operating across the UK, India, Germany, and France, Tide provides over 1.6 million members with tools for business registration, accounting, payments, expense management, and credit services.

The new capital will be used to drive Tide’s international expansion, enhance its AI-driven capabilities, and accelerate product innovation, including the rollout of its Partner Credit Services offering across Europe.

The deal also brings TPG partner Yemi Lalude onto Tide’s board, strengthening its strategic direction as the company scales its mission to simplify and modernise business banking globally.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.