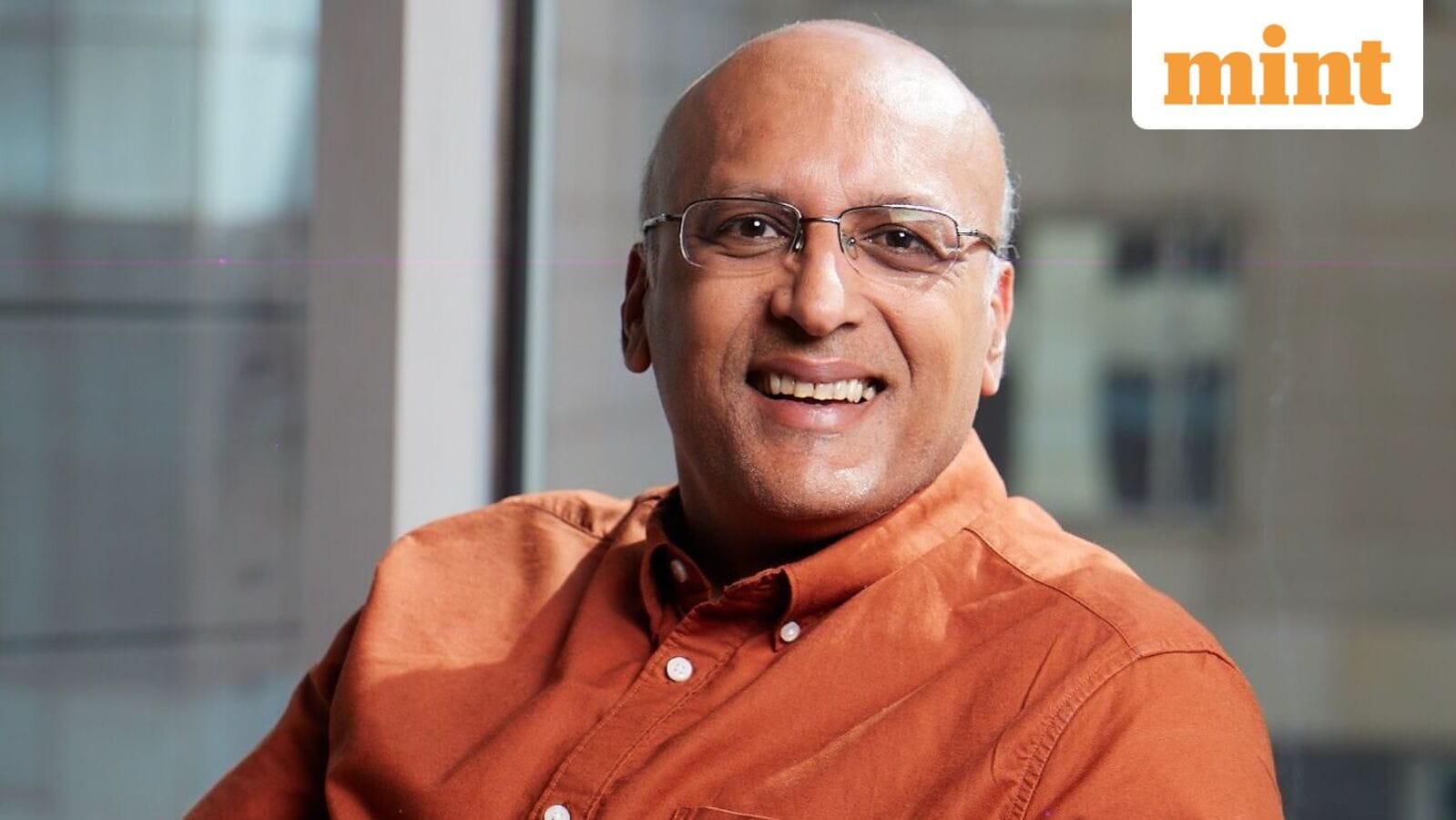

The firm wants to double down on bets in consumer, fintech and software sectors even while scouting for opportunities in sunrise sectors such as space tech, precision manufacturing, and semiconductors.

The venture capital firm which re-branded itself Peak XV in 2023—it was called Sequoia India earlier—has to its credit the bets it made investing in Zomato, Razorpay, Just Dial, Truecaller, Citrus Payment, Freshworks, Equitas, and Lal Path Labs, to name some successful exits it made. Mount Everest was called Peak XV before it was renamed in 1865.

Since its started investing in India in 2006, it has $9 billion in assets under management among the highest in the Indian venture capital space.

“I will be surprised if the pace of value creation in not faster in the coming decade,” Bhatnagar told Mint. The firm holds 11.3% stake in soon to be listed e-commerce challenger Meesho potentially sitting on a near-26 times return, valuing its stake at over ₹5,340 crore.

The firm first invested in the company in 2018 when it led Meesho’s Series B round of $11.5 million following it up with funding rounds in 2019 and 2024. “Each time, we did not just participate but led these rounds, showing our conviction in what the company was building,” Bhatnagar said. Calling Meesho a special company, he hinted at the Peak XV’s plan to continue to hold onto its stake post listing in the long term and ride the upside.

He said what attracted Peak XV to Meesho was the unique choices that its founders, Vidit Aatrey and Sanjeev Barnwal, had made. “The first one was they had decided to run a zero-inventory platform with the third-party logistics model, which was very unique versus all the incumbents that were battling it out [with] then, burning billions of dollars to compete with each other,” Bhatnagar said.

The Peak XV MD feels Meesho has turned out to be a little David amongst many Goliaths that built a frugal business. “But these guys had found a wonderful way to enter into these hard-to-reach households without burning tons of capital because they were aggregating demand with these resellers. So, zero inventory platform, very low customer acquisition cost (CAC) was the original reason that we really wanted to invest into this company,” he added.

And this the reason why the ten-year-old company saw its ₹5,421.2 crore initial public offer being subscribed 79.03 times by the final day of the bidding on Friday, 5 December.

Much larger outcomes in future

Such outsized outcomes, says Bhatnagar will be replicated for the firm over the next decade as well.

“The next founder who’s getting started is looking at how does he become a $50 billion or $100 billion company? We tend to own 10 to 15% of these companies when they go public… 10 to 15% of a $10 billion company is maybe a billion dollars outcome, but when that outcome goes 5x of course, our businesses will only deliver more, so both in terms of the speed with which we can deliver value as well as the size of the outcomes, I’d be disappointed if they’re not much larger in the future,” Bhatnagar, who calls himself an India bull, an optimist, said.

He named exports as one segment of the Indian economy that hasn’t delivered the way it was envisioned by investors a decade back. “With all the geopolitical changes that we saw, there was an opportunity for India to play a much larger role in many businesses where the world is dependent just on one country called China. We haven’t seen that play out completely. The current tariffs don’t help that,” he said.

Asked if there is worry about software as a service, or Saas, companies seeing an unprecedented slowdown, Bhatnagar said that the pendulum seems to swing wildly when it comes to investor sentiment. “There’s no way an industry that everybody thought was so important just two years back, suddenly just doesn’t exist. That just doesn’t make logical sense. What has happened right now is with the advent of AI (artificial intelligence)… because AI thoroughly disrupts so many businesses, the easy, softer, easier parts of software are being automated away by AI,” he said.

“…there will be a need for many, many companies… vertical companies that will have to work and create these software solutions and use benefits of AI where they can in order to sort of deliver the value. So don’t write off anything, is the way I would say,” Bhatnagar said, adding that it’s very hard to raise money today as a founder unless you have an AI in your roadmap.