The month of January 2026 turned out to be optimistic for the Indian startup ecosystem as venture capital (VC) funding rose by 30%, driven largely by a higher volume of deals during this period.

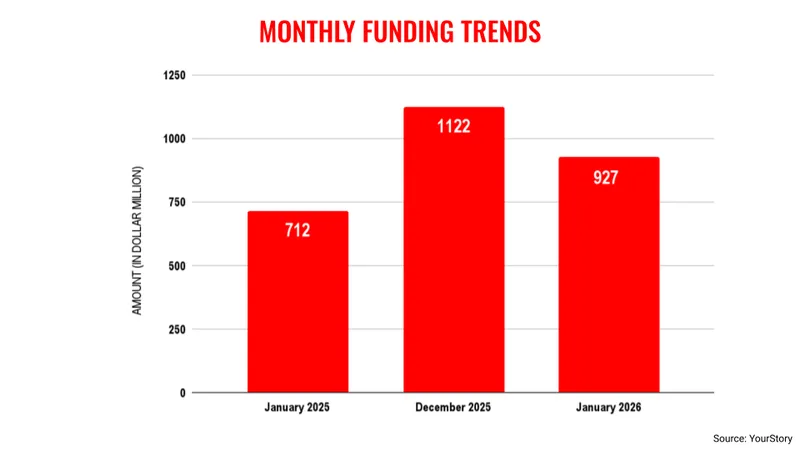

The total VC funding for January 2026 came in at $927 million across 120 deals. In contrast, January 2025 saw VC funding of $712 million, data compiled by YourStory Research reveals. However, when compared to December 2025, when the funding raised was $1,122 million, it was a decline of 17.3%.

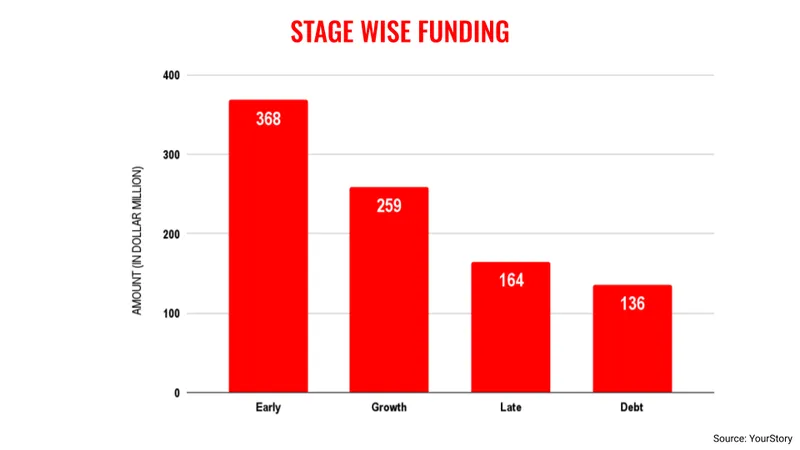

The highlight for the month of January 2026 has been the volume of deals. This is the highest number of deals on a monthly basis since January 2025. Also, the month showed the strongest traction in the early stage category of funding with 95 deals, followed by growth stage at 14 and late with 3.

These trends reveal that despite the subdued environment in the overall funding momentum, the signs of activity in the early-stage funding category reveal that entrepreneurial activity in terms of new startups remains, and investors are backing such ventures.

The VC funding raised in January 2026 came very close to the important benchmark of $1 billion, and interestingly, this happened despite the absence of large deals i.e, those with a value of $100 million and above. The key deals during this month were Greencell Mobility ($89 million), Arya . ag ($80.5 million), and Juspay ($50 million).

In terms of stage-wise funding, the early stage category received the highest amount at $368 million, followed by growth ($259 million), late ($164 million) and debt ($136 million). Generally, it is the late-stage funding category which determines the inflow of capital, as these are largely high-value transactions. January saw subdued activity from this category.

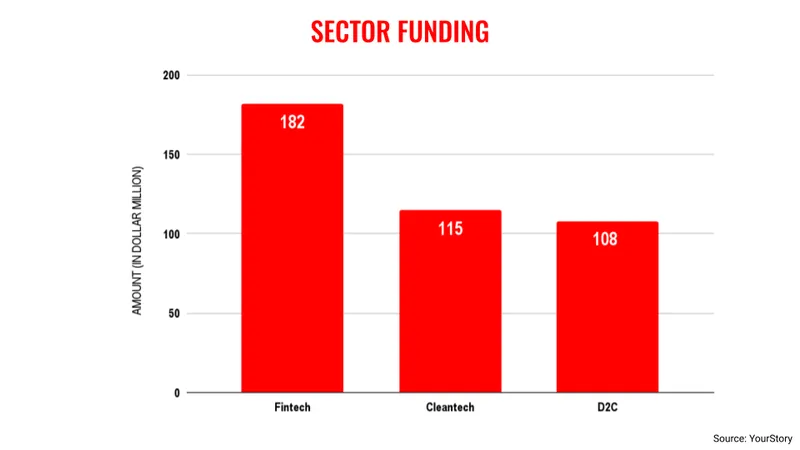

Among the sectors that received funding during the month of January, fintech led the pack with $182 million, followed by cleantech ($115 million) and D2C ($108 million). The disappointing element here is the complete absence of any artificial intelligence (AI) startups raising funding. Though Emergent, a vibe coding AI startup with strong Indian origin raised $70 million in funding, this company is headquartered in the United States.

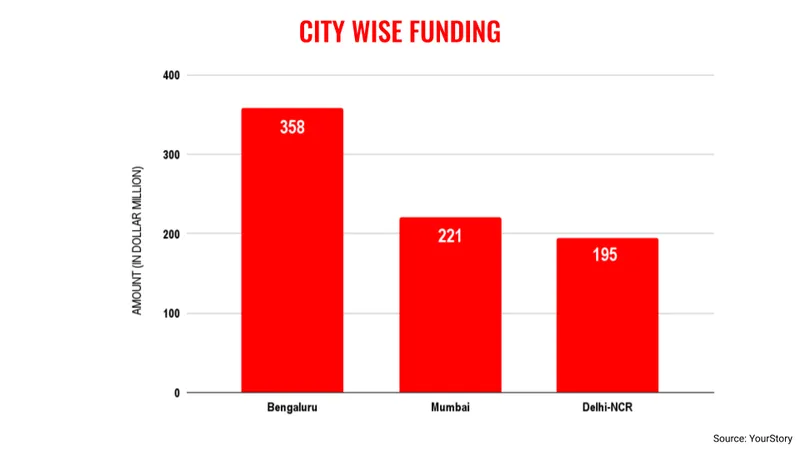

The cities that raised the highest amount of funding in the month of January 2026 remained on the same track. Bengaluru led the list at $358 million, followed by Mumbai at $221 million and Delhi-National Capital Region (NCR) with $195 million. This continues to remain a bugbear for the Indian startup ecosystem, where entrepreneurial activity and the investors continue to be concentrated in these three cities and never really made any meaningful progress into other metros of the country.

In fact, for the month of January 2026, Jaipur came in fourth place, raising $50 million. This actually calls for measures to see that other cities are also able to raise funding from investors for the entrepreneurs residing in these locations.

The month of January 2026 can be termed as a mixed bag for the Indian startup ecosystem as VC funding came close to $1 billion with expanded deal activity, but could not beat the number of December 2025.