(Bloomberg) —

Meesho Ltd., an Indian e-commerce platform, surged in its debut in Mumbai on Wednesday, showing growing investor appetite for tech startups after a string of blockbuster listings.

Most Read from Bloomberg

Shares of the SoftBank Group Corp.–backed company rose as much as 60% in Mumbai following its $603 million initial public offering. They pared gains to close at 170.09 rupees, still up 53% over the offer price of 111 rupees. This also marked one of the strongest performances for Indian IPOs this year, and valued the company at $8.5 billion.

Meesho’s debut comes amid a rush by Indian companies to raise funds in the primary market, making India the fourth-biggest IPO venue in the world this year. The deals have surpassed last year’s peak, and the demand is particularly intense for tech startups, a segment investors see as critical to India’s growth.

“Heading into 2026, Indian IPO market continues to look strong,” Pramod Kumar, India chief executive officer at Barclays Plc, told Bloomberg TV in an interview. “IPO activity may go into a third year of very strong performance,” he said.

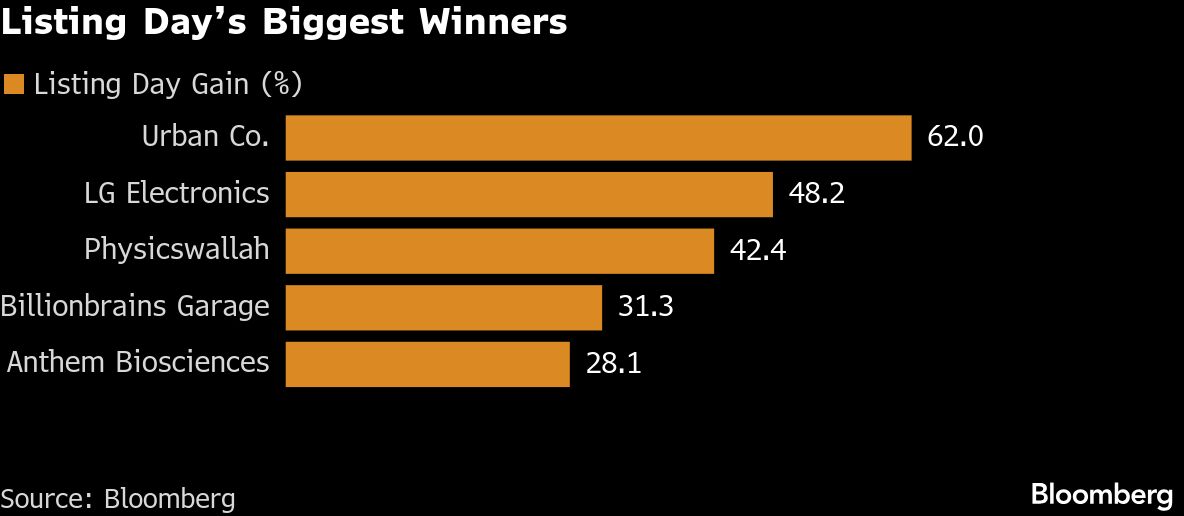

Online marketplace Urban Co. and Billionbrains Garage Ventures Ltd., the parent of India’s top discount broker Groww, had also surged on their listing.

To be sure, about half of the 333 firms listed so far this year are trading below their offer price, exposing a widening gap between issuance momentum and post-listing performance, according to data compiled by Bloomberg. Eyewear retailer Lenskart Solutions Ltd. has swung between gains and losses after its $810 million IPO, triggering a debate about lofty startup valuations. A strong performance by Meesho may help ease concerns about India’s hot IPO market.

Meesho runs a marketplace which connects small manufacturers with value-conscious consumers across India’s smaller cities. Its IPO was subscribed more than 79 times despite a dramatic anchor allocation round that saw several major funds walk away, Bloomberg News reported earlier this month.

Choice Equity Broking Pvt. initiated coverage on the company with a buy rating and a price target of 200 rupees, as it backs the startup to turn an operating profit by March 2027. The Bengaluru-headquartered firm reported a loss of 39.4 billion rupees on revenue of about 94 billion rupees for the year ended March.