Sponsor content is created on behalf of and in collaboration with PITON-Global by DigitalCommerce360. Our editorial staff is not involved in the creation of the sponsored content.

Why eCommerce outsourcing to the Philippines has become a strategic advantage for global retailers—and how next-generation fraud detection is redefining the role of BPO in the Philippines.

Executive Summary

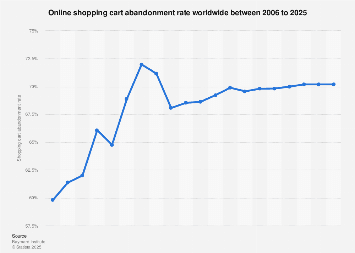

eCommerce outsourcing to the Philippines has evolved from a cost-driven decision into a strategic advantage for global retailers facing rapidly escalating cyber threats. As eCommerce fraud becomes more sophisticated—driven by account takeovers, synthetic identities, refund abuse, and automated bot attacks—traditional rule-based fraud controls are no longer effective.

Leading eCommerce BPOs in the Philippines now deploy next-generation fraud detection systems that combine machine learning, behavioral analytics, device intelligence, real-time global threat intelligence, and highly trained human fraud analysts. These AI-augmented operations consistently deliver 40–60% reductions in fraud losses, 50–70% fewer false positives, and 60–75% lower chargeback rates, while maintaining 50–60% cost advantages over in-house teams.

Unlike static rules engines, machine-learning models analyze 200+ behavioral and transactional signals in real-time, adapting continuously to new fraud patterns. Combined with expert human investigation, this hybrid model transforms fraud prevention from a defensive cost center into a scalable growth enabler for global eCommerce.

Why eCommerce Outsourcing to the Philippines Is Evolving Beyond Cost Savings

For more than two decades, eCommerce outsourcing to the Philippines has been closely associated with cost efficiency, scalability, and high-quality customer support. Today, that definition is rapidly expanding.

As cybercrime accelerates and fraud becomes more technologically sophisticated, global retailers are no longer outsourcing purely for operational leverage—they are outsourcing for risk intelligence, fraud resilience, and revenue protection.

“For years, outsourcing to the Philippines was primarily about cost efficiency and scale,” says John Maczynski, CEO of PITON-Global, a leading advisory firm specializing in eCommerce BPO to the Philippines. “Today, fraud prevention has become one of the most strategic drivers. Online retailers are now moving operations to Manila because they need smarter defenses, not just lower costs.”

Global online retail fraud losses now exceed $48 billion annually, with fraud rates increasing 18% year over year. Against this backdrop, a few Philippine eCommerce BPOs are emerging as a frontline defense—delivering enterprise-grade fraud capabilities once limited to the world’s largest platforms.

Why Traditional Fraud Controls Are No Longer Enough

Many retailers still rely on legacy fraud controls such as static rules, transaction thresholds, and geographic blocks. These approaches fail in modern digital commerce for three reasons:

- Fraud tactics evolve faster than static rules can be updated

- Legitimate customer behavior increasingly appears “high-risk”

- False positives silently erode revenue and customer trust

In global, cross-border commerce, effective fraud prevention must be adaptive, behavioral, and intelligence-driven—capabilities now central to advanced eCommerce BPOs in the Philippines.

The Escalating Cyber Threat Landscape

Today’s eCommerce fraud environment is dominated by coordinated, technology-driven attacks:

- Account Takeover (ATO): Credential stuffing, phishing, and recycled breach data enable large-scale account compromise. ATO attacks increased 136% between 2024 and 2025, driven largely by automation.

- Synthetic Identity Fraud: Fraudsters blend real identifiers with fabricated data to create identities that mature before executing large-value fraud.

- Refund and Return Abuse: False non-receipt claims, counterfeit returns, and wardrobing cost retailers approximately $24 billion annually.

- Bot and Automation Attacks: Bots now represent 40–50% of total eCommerce traffic, enabling credential stuffing, inventory hoarding, coupon abuse, and fake reviews.

Industry research supports this shift in risk complexity. Recent global payments analysis from McKinsey’s 2025 Global Payments Report highlights how the rapid expansion of digital payment methods, real-time rails, and cross-border commerce is increasing fraud exposure while simultaneously raising the cost of false positives for merchants. As commerce becomes faster and more fragmented, fraud prevention must evolve to protect revenue without degrading customer experience—precisely the challenge advanced eCommerce BPOs in the Philippines are now designed to address.

How eCommerce BPOs in the Philippines Deliver Next-Gen Fraud Detection

Industry-leading eCommerce outsourcing providers in the country deploy fraud detection architectures that rival enterprise in-house systems—often at significantly lower cost.

Machine Learning–Driven Fraud Detection

Next-generation platforms analyze 200+ variables in real time, including transaction velocity and purchasing patterns, device fingerprinting and device reputation, behavioral biometrics, IP intelligence, geolocation risk, account age, and historical behavior.

Unlike static rules, machine-learning models retrain continuously—adapting to new fraud patterns within hours.

“What differentiates top-tier Philippine eCommerce BPOs isn’t just the technology,” Maczynski explains. “It’s the hybrid model—machine learning for scale and speed, combined with highly trained fraud analysts who understand context, intent, and emerging fraud patterns.”

Measured results include 40–60% more fraud detected and 50–70% fewer false positives.

Behavioral Analytics and Device Intelligence

Rather than relying solely on transaction data, Philippine eCommerce outsourcing providers analyze how users behave—typing rhythm, mouse movement, navigation flow, copy-paste activity, and mobile interaction patterns. These behavioral biometrics are extremely difficult to replicate at scale, enabling fraud detection without intrusive verification or checkout friction.

Advanced device fingerprinting links fraud activity across sessions and accounts, even when cookies are cleared. Combined with real-time global threat intelligence, this shared-defense model reduces exposure windows and strengthens cross-border fraud protection.

Table 1: Fraud Detection Technology Performance Comparison

| Detection Approach | Fraud Catch Rate | False Positive Rate | AdaptationSpeed | Business Impact |

| Rule-Based Systems | 60–70% | 15–22% | Weeks | Low cost, high losses |

| Basic ML Models | 75–82% | 10–14% | Days | Incremental improvement |

| Next-Gen ML + Behavioral Analytics | 88–96% | 4–8% | Hours | Major fraud reduction |

| PH AI-Augmented eCommerce BPOs | 88–96% | 4–8% | Real time | 50–60% labor savings |

Why Human Fraud Analysts Still Matter

AI delivers speed and scale, but fraud is adversarial and contextual. Human expertise remains essential for complex cases such as synthetic identities, social engineering, and friendly fraud. Filipino fraud analysts investigate anomalies, validate identities, detect coordinated abuse, and manage chargeback representment.

Table 2: AI vs. Human vs. Hybrid Fraud Detection

| Fraud Type | AI Alone | Human Value | Hybrid Outcome |

| Stolen Cards | Very High | Low | 95%+ detection |

| Account Takeover | Moderate | High | 92–96% |

| Synthetic Identity | Low–Moderate | Very High | 85–92% |

| Refund Fraud | Moderate | High | 88–94% |

| Friendly Fraud | Low | Very High | 75–85% |

The Provider Gap in eCommerce Outsourcing to the Philippines

Not all Philippine BPOs offer genuine next-generation fraud capabilities. Many rely on basic rules engines rebranded as AI.

This distinction mirrors broader concerns raised by Gartner, which has cautioned that many organizations overstate their use of advanced AI while lacking the governance, transparency, and controls required for real operational impact.

“We see a lot of AI-washing in the market,” says Ralf Ellspermann, CSO of PITON-Global and a multi-awarded BPO executive with over 25 years of retail outsourcing experience in the Philippines. “True next-gen eCommerce BPOs invest in data science teams, behavioral analytics platforms, and continuous model refinement. The performance gap between basic and advanced providers is enormous.”

The Business Impact: From Cost Center to Competitive Advantage

Advanced fraud detection fundamentally changes how eCommerce businesses grow.

“The difference between basic and advanced fraud detection is transformational,” Ellspermann adds. “We routinely see companies move from blocking nearly 20% of legitimate customers to blocking fewer than 7%, while catching significantly more fraud.”

Table 3: Annual Economic Impact

($5M Monthly GMV eCommerce Business)

| Cost Category | In-House Detection | Industry-Leading BPOs in PH | Annual Impact |

| Fraud Losses | $1.2M | $360K | $840K saved |

| False Positives | $540K | $180K | $360K recovered |

| Chargebacks | $180K | $60K | $120K saved |

| Labor Costs | $420K | $180K | $240K saved |

| Technology | $60K | Included | $60K saved |

| Total Annual Cost | $2.4M | $780K | $1.62M net benefit |

| ROI | — | 207% | 6–8 month payback |

Key Takeaways

- eCommerce outsourcing to the Philippines has evolved into a fraud-resilience and revenue-protection strategy

- Next-generation fraud detection reduces fraud losses by 40–60% and false positives by 50–70%

- Hybrid AI and human investigation models outperform automation alone

- Philippine eCommerce BPOs deliver enterprise-grade fraud defense at 50–60% lower operating cost

- Provider selection is critical; the performance gap is transformational

Expert FAQs:

Are all eCommerce BPOs in the Philippines AI-ready with advanced fraud detection capabilities? No. Although more than 1,000 BPOs operate in the Philippines, fewer than 3% deploy truly advanced, AI-driven fraud detection at scale—primarily specialists in eCommerce, financial services, and fintech. PITON-Global works with many of the industry’s AI frontrunners in this top tier.

What are the most common hidden risks when outsourcing fraud operations?

False confidence and invisible revenue loss from outdated rules, poor model governance, and excessive false positives.

How quickly can results be achieved after outsourcing?

Initial improvements typically appear within 8–12 weeks, with full ROI achieved in 6–10 months.

Does outsourcing reduce control or transparency?

Not with advanced providers, which often offer greater visibility than in-house teams through explainable decisions and shared dashboards.

Is advanced fraud prevention more about loss reduction or growth?

Both, but the greatest long-term value is growth—approving more legitimate customers while reducing friction and risk.

Final Takeaway

As cyber threats intensify, eCommerce outsourcing to the Philippines has become a strategic growth lever. By combining next-generation fraud detection with skilled human intelligence and cost-efficient delivery models, Philippine contact centers and BPOs enable global online retailers to protect revenue, improve customer experience, and scale securely.

Fraud prevention, done right, is no longer just about stopping losses—it is about unlocking growth with confidence.

Favorite