Accel has long enjoyed a reputation as India’s most successful venture firm, with early investments in online retailer Flipkart, food delivery firm Swiggy, and cloud-software operator Freshworks.

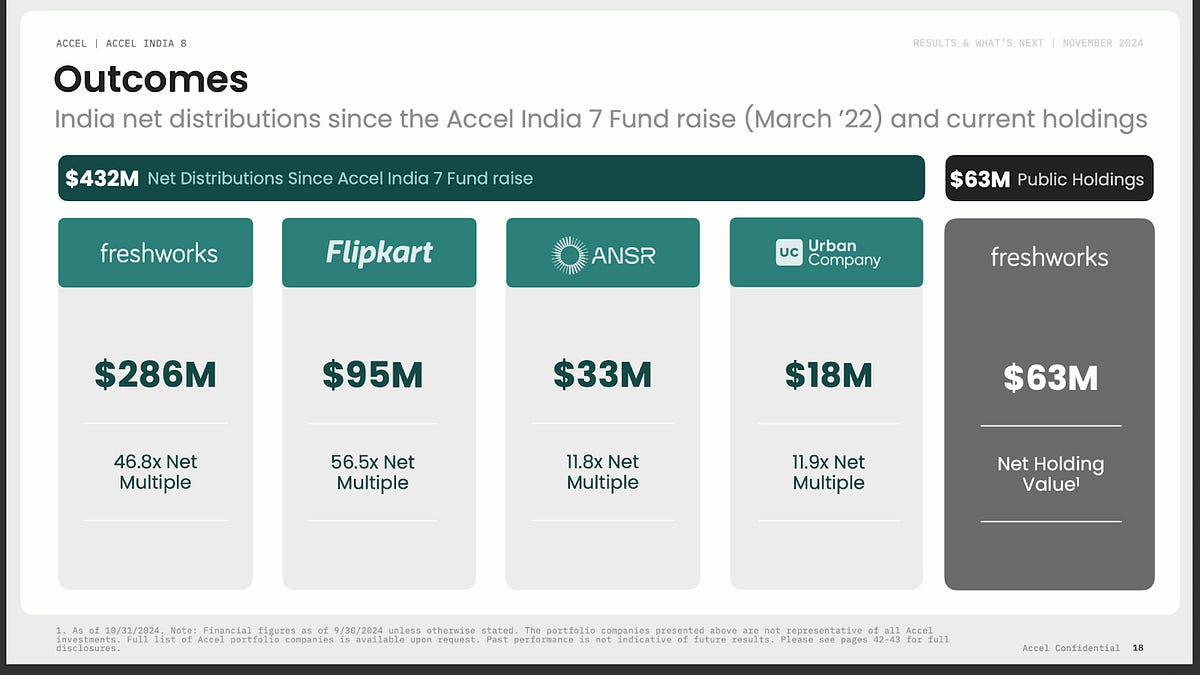

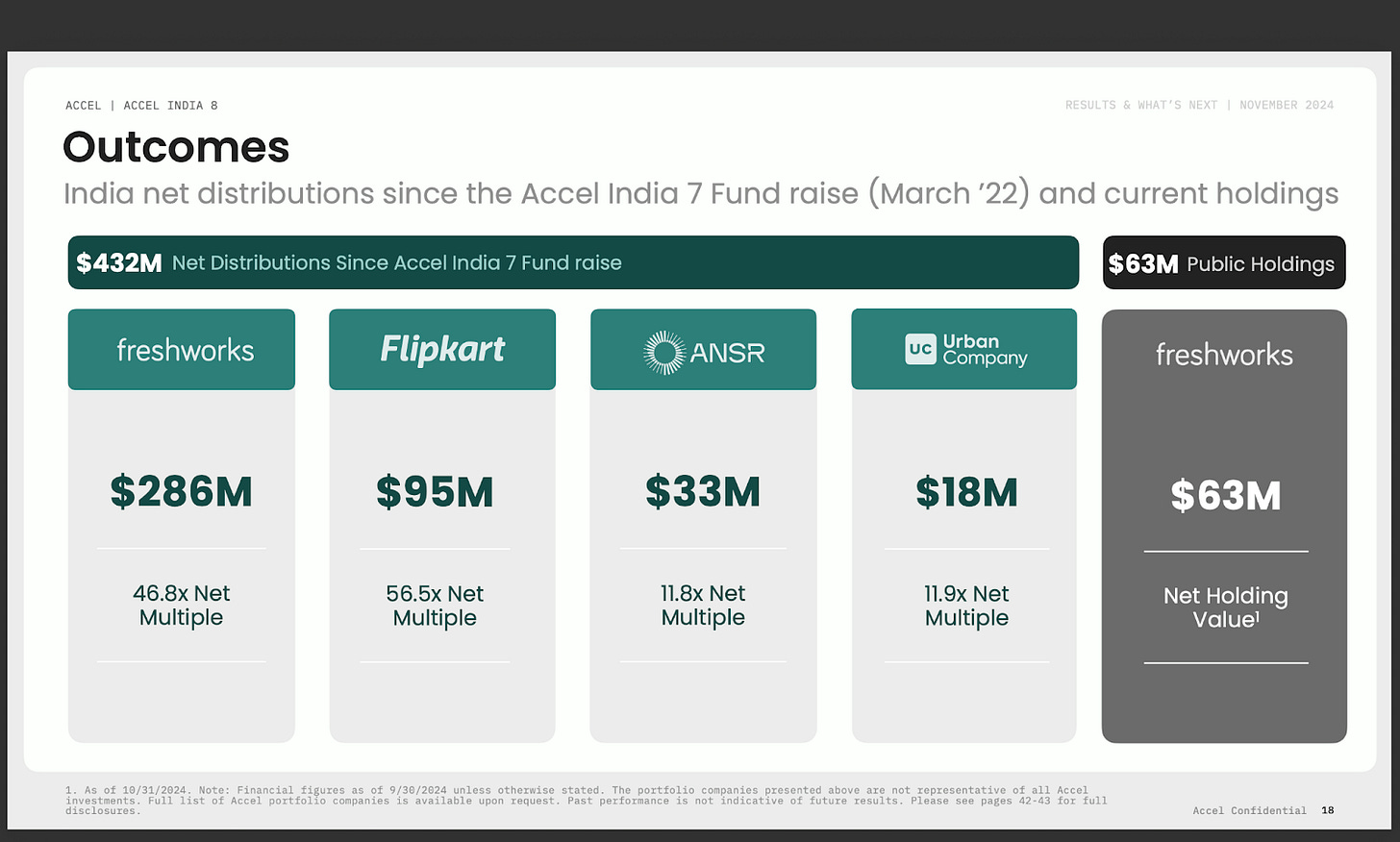

Fund return data obtained exclusively by Newcomer shows just how lucrative those investments have been for LPs in the firm’s 2008 and 2011 vintage funds, which were early to the then-nascent Indian startup market. Flipkart returned 56x Accel’s investment.

At the same time, Accel’s much larger 2014 and 2017 funds have had a tough time when it comes to returning cash to LPs, with DPI of just 0.15x and 0.13x respectively.

We got a look at Accel India’s performance numbers for six funds, never revealed publicly before, via a 45-page document the firm sent to LPs in November 2024, ahead of raising its most recent, and eighth, India fund of $650 million.

The numbers shed light on a leading global tech investor’s approach in one of the world’s largest economies, and on the broader strategy of U.S venture funds that expanded abroad over the past two decades.