“As India targets $1 trillion in merchandise exports by 2030 under the Viksit Bharat vision, e-commerce exports are projected to scale rapidly to $200-300 billion. This expansion could raise their share in India’s total exports to 20–30 per cent and their contribution to GDP [gross domestic product] to 2.9-4.3 per cent, underscoring the potential of e-commerce to emerge as a key pillar of India’s export strategy and broader economic growth,” said the report.

“Given India’s 500 million-strong labour force and 63 million MSMEs contributing ~29 per cent of GDP and 43 per cent of exports, e-commerce exports hold the potential to unlock new growth opportunities. This transition is especially significant for MSMEs [micro, small and medium enterprises], which have already enabled lakhs of small producers to access global markets through digital platforms,” it noted.

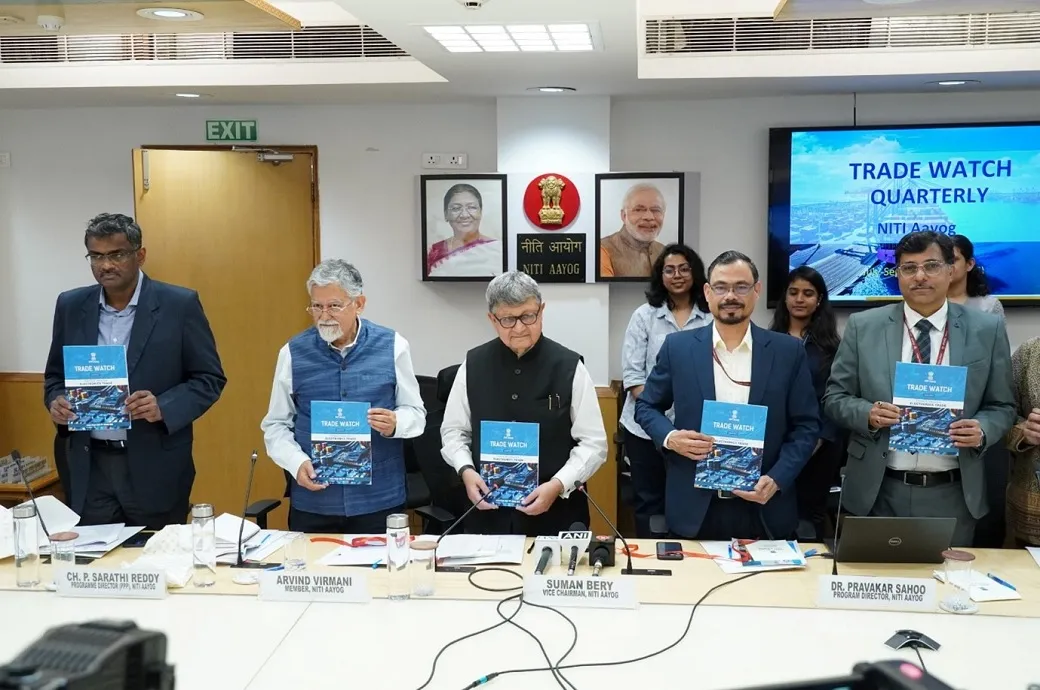

Cross-border e-commerce will primarily drive India’s export growth, backing the push towards higher merchandise exports by 2030, NITI Aayog’s Trade Watch Quarterly for Q2 FY26 said.

Constraints in India’s e-commerce export ecosystem include complex regulatory and compliance framework, absence of dedicated customs codes for e-commerce exports, inefficient reverse logistics and duty treatment of returns.

Challenges to and constraints in India’s e-commerce export ecosystem include complex regulatory and compliance framework, absence of dedicated customs codes for e-commerce exports, inefficient reverse logistics and duty treatment of returns, lack of coordinated ecosystem support, absence of an international cooperation framework and low awareness and institutional support.

In Q2 FY26, trade destinations remained broadly stable, with exports to top markets growing strongly led by Hong Kong, China and the United States, while imports from the United Arab Emirates (UAE) surged by 48 per cent YoY.

The report recommended India to enhance market access and integration into global value chains through proactive trade facilitation, government procurement support, leveraging strategic free trade agreements and anchor investments, MSME participation and higher domestic value addition.

Fibre2Fashion News Desk (DS)