Stock Performance and Market Context

On 10 Feb 2026, FSN E-Commerce Ventures Ltd touched an intraday high of Rs.283.5, representing a 2.09% increase on the day and outperforming its sector by 1.53%. The stock has been on a consistent upward trajectory, gaining for six consecutive trading sessions and delivering an impressive 18.62% return during this period. This rally has propelled the stock well above its key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages, signalling strong technical momentum.

In comparison, the Sensex also showed positive movement, rising 209.48 points to close at 84,419.48, up 0.42% on the day. The benchmark index is currently 2.06% below its own 52-week high of 86,159.02 and has gained 3.53% over the past three weeks. Mega-cap stocks have been leading the market rally, supporting overall bullish sentiment.

Long-Term Growth and Financial Strength

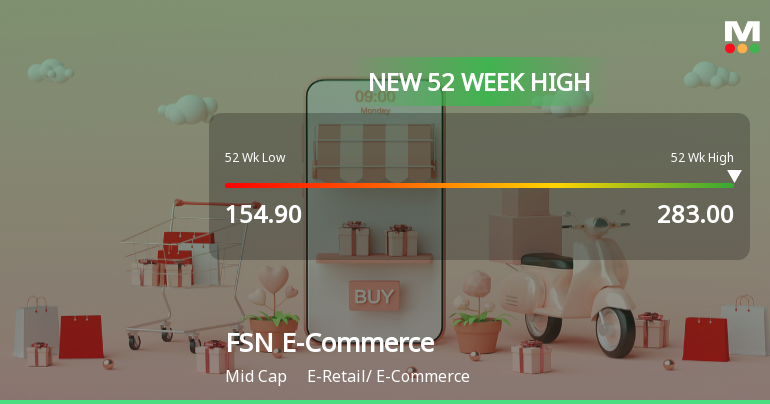

FSN E-Commerce Ventures Ltd’s one-year performance stands out with a remarkable 66.69% gain, significantly outperforming the Sensex’s 9.21% return over the same period. The stock’s 52-week low was Rs.154.9, highlighting the scale of its recent appreciation.

The company’s financials underpin this strong market performance. Net sales have grown at an annual rate of 27.76%, while operating profit has expanded by 44.04%. Notably, net profit surged by 105.4% in the latest quarter ending December 2025, marking a continuation of positive results for nine consecutive quarters. Operating profit to interest coverage reached a high of 7.88 times, and return on capital employed (ROCE) stood at 11.01%, both indicators of operational efficiency and capital utilisation.

Institutional Confidence and Valuation Metrics

Institutional investors hold a substantial 37.49% stake in FSN E-Commerce Ventures Ltd, reflecting confidence from entities with extensive analytical resources. This level of institutional holding often correlates with a thorough assessment of the company’s fundamentals and growth prospects.

Despite the strong performance, the company’s valuation metrics indicate a premium positioning. The enterprise value to capital employed ratio stands at 31.3, suggesting a very expensive valuation relative to capital base. The price-to-earnings-to-growth (PEG) ratio is 2.8, reflecting the market’s expectations of continued profit growth. Return on equity (ROE) averages 3.89%, indicating modest profitability per unit of shareholder funds.

Sector and Peer Comparison

Within the e-retail and e-commerce sector, FSN E-Commerce Ventures Ltd has demonstrated market-beating performance not only in the short term but also over longer horizons. The stock has outperformed the BSE500 index over the last three years, one year, and three months, underscoring its consistent growth trajectory relative to peers.

Operating profit to net sales ratio reached a peak of 8.00%, highlighting efficient cost management and revenue generation. These metrics place FSN E-Commerce Ventures Ltd favourably among its sector counterparts, reinforcing its position as a leading player in the e-commerce space.

Recent Rating Upgrade and Market Sentiment

On 6 Feb 2026, FSN E-Commerce Ventures Ltd’s Mojo Grade was upgraded from Hold to Buy, reflecting improved confidence in the company’s growth and financial health. The current Mojo Score stands at 75.0, signalling a favourable outlook based on comprehensive analysis of fundamentals, valuation, and momentum.

The company’s market capitalisation grade is 2, indicating a mid-cap status within the e-retail sector. The stock’s day change of 1.75% on the latest trading session further emphasises its positive momentum amid a broadly rising market environment.

Summary of Key Financial Indicators

FSN E-Commerce Ventures Ltd’s financial highlights include:

- Net sales growth at 27.76% annually

- Operating profit growth of 44.04%

- Net profit increase of 105.4% in the latest quarter

- Operating profit to interest coverage ratio at 7.88 times

- ROCE at 11.01%

- Operating profit to net sales ratio at 8.00%

- Institutional holdings at 37.49%

These figures illustrate the company’s ability to generate strong earnings growth and maintain operational efficiency, contributing to the stock’s upward price movement.

Market Risks and Valuation Considerations

While the stock’s performance has been robust, certain financial ratios suggest areas of caution. The company’s average EBIT to interest ratio is 1.83, indicating a relatively weak capacity to service debt obligations. Additionally, the average return on equity of 3.89% points to modest profitability relative to shareholder funds.

Valuation metrics such as the enterprise value to capital employed ratio of 31.3 and PEG ratio of 2.8 suggest the stock is priced at a premium compared to historical averages and peers. Investors should consider these factors when analysing the stock’s current price level.

Conclusion

FSN E-Commerce Ventures Ltd’s ascent to a new 52-week high of Rs.283.5 marks a noteworthy achievement driven by strong financial results, sustained growth, and positive market dynamics. The stock’s consistent gains over the past six days and outperformance relative to sector and benchmark indices underscore its momentum in the e-retail space. While valuation metrics indicate a premium, the company’s operational metrics and institutional backing provide a solid foundation for its current market standing.

Unlock special upgrade rates for a limited period. Start Saving Now →