Stock Performance and Market Context

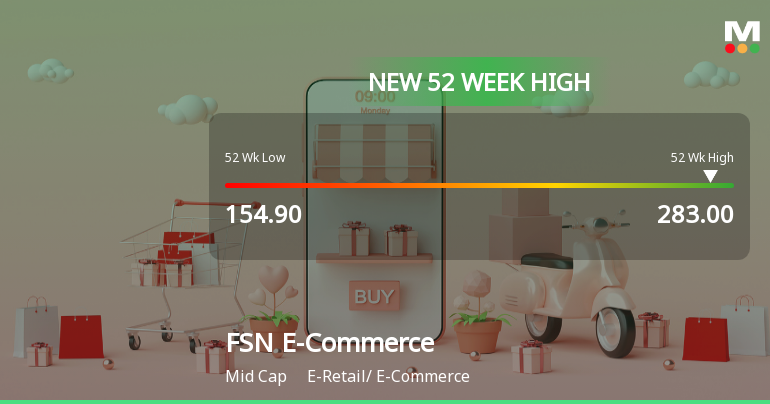

On 9 Feb 2026, FSN E-Commerce Ventures Ltd touched an intraday high of Rs.283, representing a 2.15% gain during the trading session. This new peak surpasses the previous 52-week high, underscoring the stock’s strong momentum over the past year. Despite a slight pullback of 0.94% on the day, the stock remains well above its key moving averages, trading higher than its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, signalling sustained upward momentum.

In comparison, the broader Sensex opened higher at 84,177.51, gaining 597.11 points (0.71%) but was trading slightly lower at 83,974.31 (down 0.47%) during the same period. The Sensex is currently 2.6% away from its own 52-week high of 86,159.02, with mega-cap stocks leading the market gains. Over the last three weeks, the Sensex has recorded a 2.99% rise, reflecting a generally positive market sentiment.

Long-Term Growth and Financial Strength

FSN E-Commerce Ventures Ltd’s stock performance is supported by robust financial metrics and consistent growth. Over the past year, the stock has delivered a remarkable 57.55% return, significantly outperforming the Sensex’s 7.88% gain over the same period. The company’s 52-week low was Rs.154.90, highlighting the substantial appreciation in share price within the last twelve months.

The company has demonstrated healthy long-term growth, with net sales expanding at an annual rate of 27.76% and operating profit increasing by 44.04%. Net profit growth has been particularly impressive, surging by 105.4% in the most recent quarter ending December 2025. This marks the ninth consecutive quarter of positive results, reflecting sustained operational strength.

Profitability and Efficiency Metrics

FSN E-Commerce Ventures Ltd’s operational efficiency is reflected in several key ratios. The company’s operating profit to net sales ratio reached a high of 8.00% in the latest quarter, while operating profit to interest coverage stands at an impressive 7.88 times, indicating strong ability to cover interest expenses. The return on capital employed (ROCE) for the half-year period is recorded at 11.01%, underscoring effective utilisation of capital.

Institutional investors hold a significant 37.49% stake in the company, suggesting confidence from entities with extensive analytical resources. This level of institutional ownership often correlates with a more stable shareholder base and can contribute to sustained stock performance.

Valuation and Risk Considerations

Despite the strong growth and profitability, certain valuation and financial metrics warrant attention. The company’s average EBIT to interest ratio is relatively low at 1.83, indicating a modest cushion for debt servicing. Return on equity (ROE) averages 3.89%, which is comparatively low, signalling limited profitability per unit of shareholders’ funds.

Valuation metrics suggest the stock is trading at a premium, with an enterprise value to capital employed ratio of 31.2, categorising it as very expensive relative to capital utilisation. However, the stock’s current price remains at a discount compared to peers’ historical averages. The price-to-earnings-to-growth (PEG) ratio stands at 2.8, reflecting the relationship between valuation and earnings growth.

Recent Rating Upgrade and Market Position

On 6 Feb 2026, FSN E-Commerce Ventures Ltd’s Mojo Grade was upgraded from Hold to Buy, reflecting improved market sentiment and fundamental assessment. The company holds a Mojo Score of 75.0, indicating a favourable outlook based on comprehensive analysis. The market capitalisation grade is 2, placing it within a mid-tier valuation bracket.

The stock’s recent trend shows a reversal after four consecutive days of gains, with a slight underperformance of 0.68% relative to its sector on the day it reached the new high. Nonetheless, the overall trajectory remains positive, supported by strong financial results and market dynamics.

Comparative Market Performance

FSN E-Commerce Ventures Ltd’s one-year performance of 57.55% significantly outpaces the broader Sensex gain of 7.88%, highlighting its market-beating returns. Over the last three years, one year, and three months, the stock has consistently outperformed the BSE500 index, reinforcing its position as a strong performer within the e-retail and e-commerce sector.

The company’s sector continues to benefit from evolving consumer behaviour and digital adoption, factors that have contributed to the sustained growth in sales and profitability metrics.

Summary of Key Financial Highlights

To summarise, FSN E-Commerce Ventures Ltd’s stock reaching Rs.283 as a new 52-week high is underpinned by:

- Net sales growth at an annual rate of 27.76%

- Operating profit growth of 44.04%

- Net profit increase of 105.4% in the latest quarter

- Strong operating profit to interest coverage ratio of 7.88 times

- ROCE at 11.01% for the half-year period

- Institutional holdings at 37.49%

- Consistent positive quarterly results over nine consecutive quarters

These factors collectively contribute to the stock’s robust momentum and its ability to sustain new highs in a competitive market environment.

Upgrade at special rates, valid only for the next few days. Claim Your Special Rate →