Intraday Trading Highlights

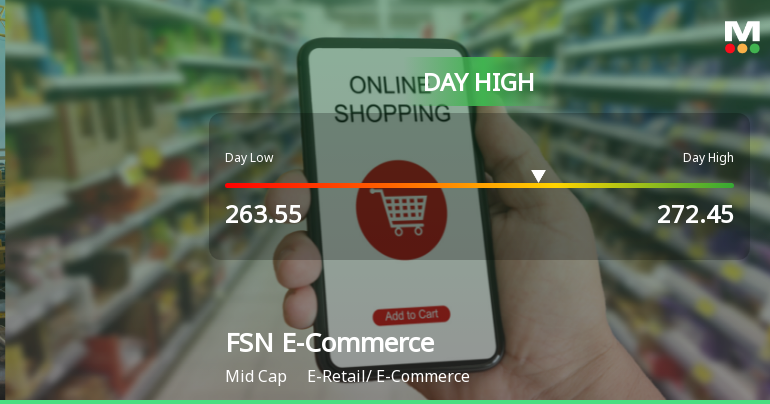

The stock opened with a notable gap up of 2.92%, signalling strong buying interest from the outset. Throughout the trading session, FSN E-Commerce Ventures Ltd maintained upward momentum, reaching a peak price of Rs 271.9, just 1.41% shy of its 52-week high of Rs 273.2. This intraday high represents a 5.29% increase relative to the previous day’s close, underscoring the stock’s strong demand in the market today.

Trading volumes remained elevated, supporting the price advance and reflecting sustained investor engagement. The stock’s performance today outpaced the E-Retail/ E-Commerce sector by 4.77%, highlighting its relative strength amid a broadly cautious market environment.

Technical Positioning and Moving Averages

FSN E-Commerce Ventures Ltd is trading above all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages. This technical positioning indicates a strong upward trend and suggests that the stock has maintained positive momentum over multiple time frames. The consistent gains over the past four trading days have resulted in a cumulative return of 13.36%, reinforcing the stock’s bullish trajectory in the short term.

Comparative Market Context

While FSN E-Commerce Ventures Ltd advanced by 5.05% on the day, the benchmark Sensex declined by 0.39%, closing at 82,987.28 points after falling 262.04 points from its flat opening. The Sensex remains 3.82% below its 52-week high of 86,159.02 and is trading below its 50-day moving average, which itself is positioned above the 200-day moving average. This contrast highlights FSN E-Commerce Ventures Ltd’s outperformance relative to the broader market.

Over longer periods, FSN E-Commerce Ventures Ltd has delivered substantial returns, including a 56.14% gain over the past year and a 97.17% increase over three years, significantly outpacing the Sensex’s respective returns of 6.32% and 37.15%. Year-to-date, the stock has risen 2.24%, while the Sensex has declined 2.62%, further emphasising the stock’s relative strength.

Mojo Score and Rating Update

As of 4 Feb 2026, FSN E-Commerce Ventures Ltd holds a Mojo Score of 68.0 with a Mojo Grade of Hold, downgraded from a Buy rating. The Market Cap Grade stands at 2, reflecting its mid-cap status within the E-Retail/ E-Commerce sector. Despite the recent rating adjustment, the stock’s price action today demonstrates resilience and continued investor interest.

Recent Price and Performance Summary

Today’s 5.44% day change marks a significant intraday gain, with the stock closing near its session high. The four-day consecutive gain period has contributed to a 13.36% return, underscoring a sustained positive trend. The stock’s proximity to its 52-week high at Rs 273.2, being only 1.41% away, indicates that it is trading near peak levels seen over the past year.

Sector and Industry Positioning

Operating within the E-Retail/ E-Commerce sector, FSN E-Commerce Ventures Ltd’s strong intraday performance today stands out amid mixed market conditions. The sector itself has experienced varied performance, but FSN’s ability to outperform its peers by 4.77% today highlights its relative strength and market interest.

The stock’s technical indicators, including its position above all major moving averages, suggest that it remains in a favourable trend phase. This technical strength is supported by the stock’s consistent gains over recent sessions and its proximity to historical highs.

Summary of Key Metrics

To summarise, FSN E-Commerce Ventures Ltd’s key intraday and recent performance metrics include:

- Intraday high of Rs 271.9, a 5.29% increase on the day

- Day change of 5.44%

- Opened with a 2.92% gap up

- Four consecutive days of gains, totalling 13.36% returns

- Trading above 5, 20, 50, 100, and 200-day moving averages

- Close to 52-week high, just 1.41% below Rs 273.2

- Outperformed sector by 4.77% and Sensex by 5.44% vs -0.39%

- Mojo Score of 68.0 with a Hold rating as of 4 Feb 2026

These figures collectively illustrate the stock’s strong intraday showing and sustained positive momentum in recent sessions.

Market Sentiment and Broader Index Performance

While FSN E-Commerce Ventures Ltd advanced, the broader market displayed a more cautious tone. The Sensex declined by 0.39%, weighed down by a 262.04-point drop from its flat opening. This divergence between the stock and the benchmark index highlights FSN’s relative outperformance and resilience in a market environment that was otherwise subdued.

The Sensex’s current position below its 50-day moving average, despite the 50DMA trading above the 200DMA, suggests a mixed technical outlook for the broader market. In contrast, FSN’s technical indicators remain firmly positive, reinforcing its current strength.

Conclusion

FSN E-Commerce Ventures Ltd’s strong intraday performance on 6 Feb 2026, marked by a 5.44% gain and an intraday high near its 52-week peak, reflects robust trading activity and sustained momentum. The stock’s technical positioning above all major moving averages and its outperformance relative to both its sector and the Sensex underscore its current market strength. The four-day consecutive rise and proximity to historical highs further highlight the stock’s positive trend in the near term.

Upgrade at special rates, valid only for the next few days. Claim Your Special Rate →