Y Combinator, the world’s most famous startup accelerator programme, had a blockbuster end to 2025.

YC raked in close to $200 million when two of its portfolio companies from India went public in blockbuster listings.

When fintech startup Groww held its IPO in November, YC banked an estimated $117 million from selling part of its stake. But there’s plenty more to come as it still owns 10% of the business. That’s worth around $1 billion at current prices.

Groww was YC’s first India IPO, but it was quickly followed by a second when Meesho listed in December. YC cashed nearly $10 million from the float, with around $50 million in remaining stock. That’s a more than 100X return on its investment in the e-commerce startup back in 2017.

More than 9,000 companies have graduated from the YC programme, which gives a whistlestop education in startup culture with mentorship from a star cast of staff and advisors. Its alumni include Coinbase, Stripe, Dropbox, Airbnb, Brex, Twitch and Cruise. It has real pedigree.

Two astronomical exits like Meesho and Groww might look like the start of an empire for YC in India, but that’s not the case. Participation numbers from India and Asia are in deep decline.

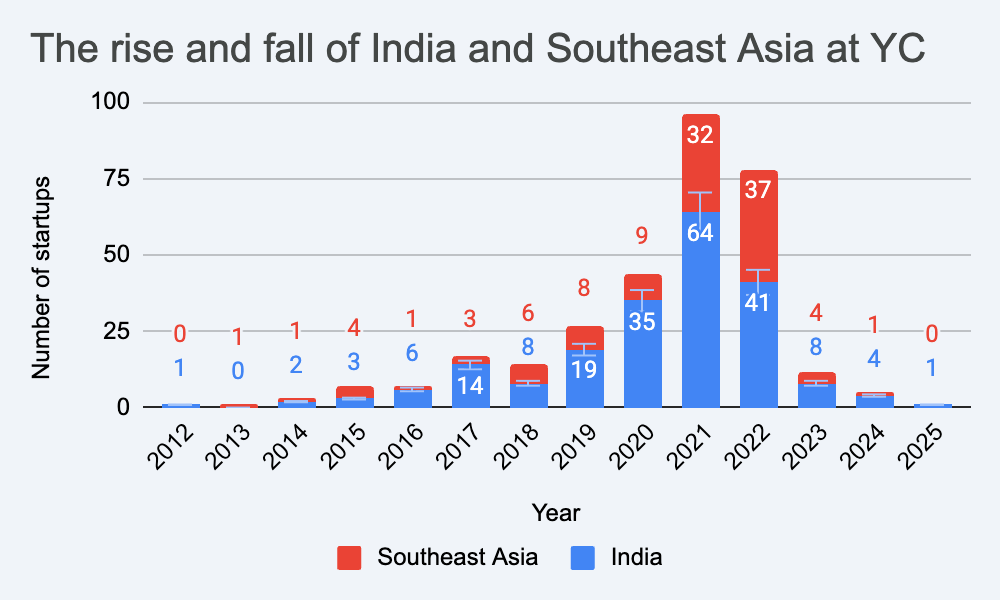

The California-based accelerator programme saw participation from India and Southeast Asia rocket during the pandemic, with 44 startups from the two regions in 2020, 96 in 2021 and 78 in 2022. Those three years account for 90% of the Indian and Southeast Asian startups to take part in YC since 2012.

In 2024, just four Indian startups and one Southeast Asian startup were part of any YC programme. Last year, YC welcomed just one Asian startup: Bolna, a startup developing AI voice agents in local Indian languages.

The marriage between Asian startups and YC is on the rocks, despite these incredible wins.

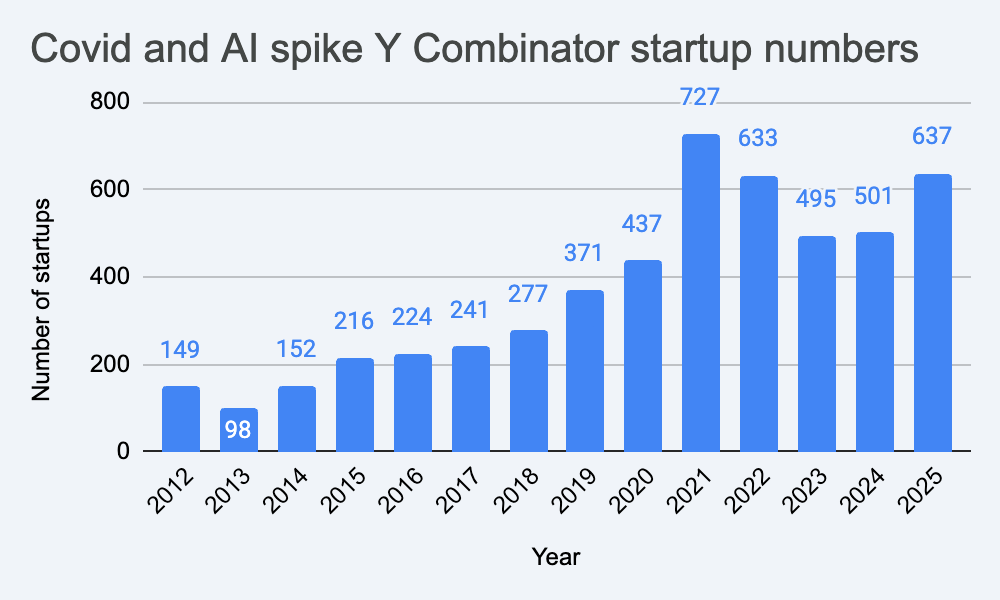

Covid was an era-defining moment for global venture capital, but the next change of focus came fast with the release of OpenAI’s ChatGPT artificial intelligence (AI) product for consumers in November 2022.

The launch of ChatGPT put AI and generative AI for consumers on the map. Suddenly, every VC fund developed its own narrative and strategy for AI, given the emerging technology’s potential to disrupt any vertical or industry.

The pivot at YC was heavy. More than 70% of the intake across its two programmes in 2023 were classified as AI businesses. The majority were based in the US, the location for prime engineering talent in the world and where AI startups first emerged. Just six of the 349 YC startups in 2023 came from South Asia or Southeast Asia.

This was the opposite of YC programmes during the pandemic.

The strategy of remote cohorts, which allowed startups from anywhere in the world to join, was gone. In its place, a return to a hacker-like culture which demanded founders to be present in person, iterating alongside each other with new tools that evolved on a seemingly day-to-day basis.

It could have been different. Sensing the opportunity to tap into global demand, the company explored internationalising its program in 2018.

Sam Altman, the OpenAI CEO who brought ChatGPT to the world, was then YC President and he announced plans to open a startup programme in China.

I spoke to Altman at the time and wrote a story for TechCrunch. Details were vague, but it was clear that he saw huge potential to tap into founders and startups in China. He appeared to have the right person in place, former Microsoft and Baidu executive Qi Lu.

The logic was compelling. YC would gain the distribution to reach more startups, and its knowledge and insight would give founders a better chance of reaching their full potential.

“We have learned to talk to our users better and understand their needs. YC helps you learn a few habits that are important, for example focusing on one thing at a time and talking to customers every day,” Vidit Aatrey, CEO and co-founder of Meesho, told me back in 2016.

But local insight is exactly what some founders felt was missing. “Y Combinator taught me everything about building a startup. Except how to build one in Southeast Asia,” wrote Victor Riviera, whose previous startup entered YC in 2021.

But the YC China program never materialised. Altman left the organization in 2019 and the China project was shuttered under new leadership.

“As we worked to establish YC China, we had a change in leadership. With this, our strategy changed back to our tried and true approach of supporting local and international startups from our headquarters in Silicon Valley,” YC confirmed in a short blog post.

Whatever Altman’s intent, the outcome was clear. YC chose its HQ model over localisation, reaffirming a strategy anchored to Silicon Valley rather than one distributed across global hubs.

Others have made the alternative bet. Antler, founded in Singapore in 2018, has quickly grown to 22 markets worldwide and more than 1,500 portfolio startups. Unlike YC, Antler did not prioritise the US market. It did not even have an outpost in San Francisco until June 2025.

India thrives, but Southeast Asia struggles

The numbers are down, but YC’s India portfolio boasts numerous startups with real exit potential.

Quick commerce startup Zepto is said to be aiming to go public this year. Fintech business Razorpay is on the same path but with a later schedule.

YC saw a surge during Covid in line with increased participation from startups outside of the US, its numbers spiked again in 2025 following a change to four annual cohorts

Perhaps India’s buoyant IPO window has made YC less appealing. The local venture capital industry has grown significantly with more early-stage funds than ever, and accelerator programmes that cater to domestic startups.

Then there’s the thorny issue of incorporation.

YC requires companies to be incorporated in the US, with Canada, Cayman Islands and Singapore other options. It’s already standard practice for most international startups that want to raise capital from investors worldwide. Except those in India, which must be locally incorporated to go public.

Redomiciling is costly and time-consuming. Meesho paid nearly $300 million in US taxes to relocate its company registration to India. The same flip cost Groww an estimated $160 million.

YC shows no sign of dropping the requirement, despite a recent u-turn on Canada, which gives Indian founders a big decision to make so early in the life of their company.

The situation for YC looks bleaker in Southeast Asia. Participation in the programme helped startups raise capital, but there aren’t obvious exits for its portfolio in the region.

Southeast Asia’s IPO market is less accessible and M&A opportunities are scarce and typically happen at sub-$100 million valuations. Then there’s the recent funding winter, which saw investment plummet to levels last seen a decade ago.

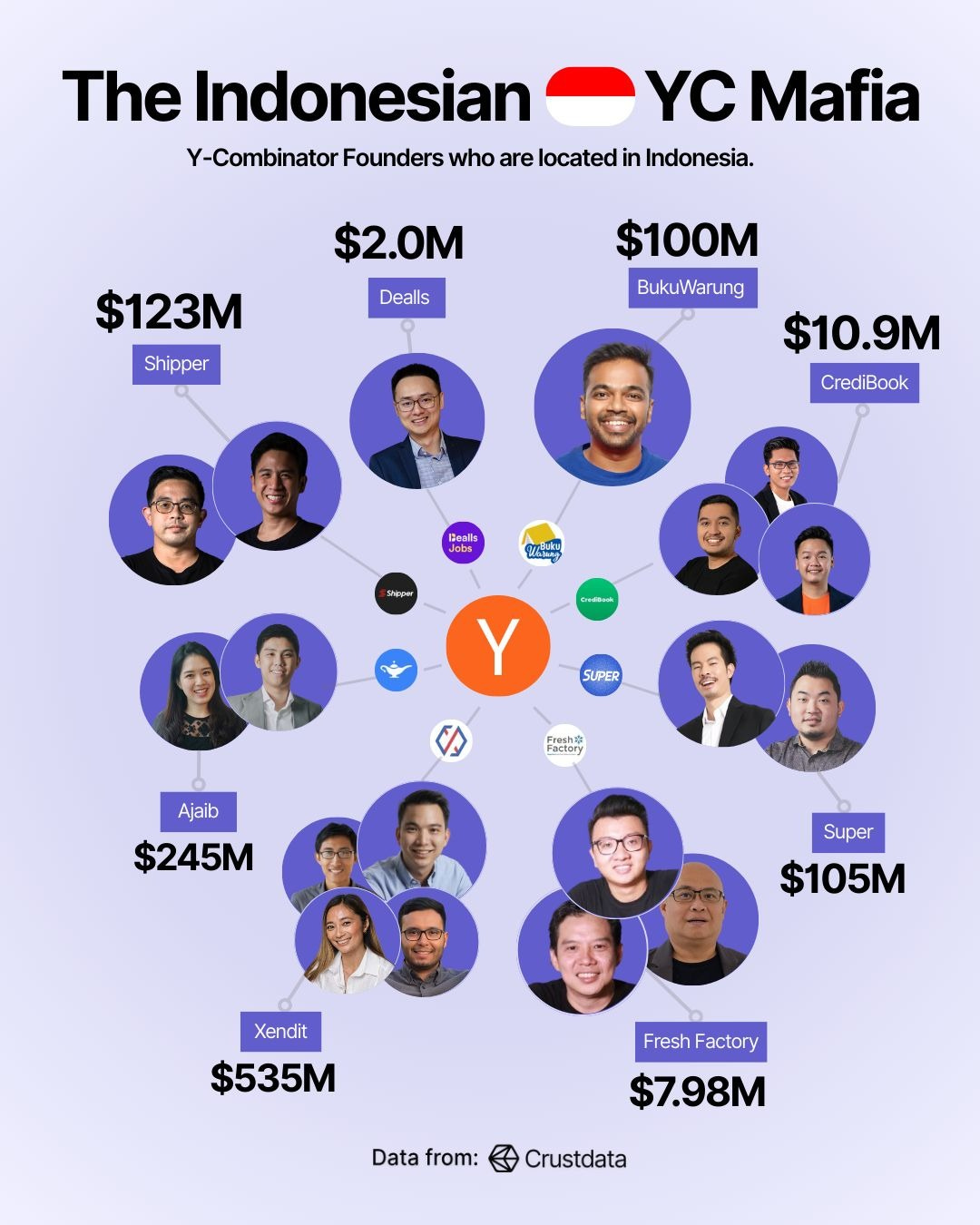

YC startups in Indonesia raised significantly more than their peers. This could be YC picking great companies, great founders applying to the programme or simply the YC brand making startups more attractive to other investors (Image Chris Pisarski)

The new model for YC in Asia is typified by Bolna, which just announced a $6.3 million funding round that was led by major US VC General Catalyst.

That calibre of lead investor is a nearly impossible get in Asia, and it almost didn’t happen. The startup told TechCrunch YC rejected their first five applications as it didn’t see the potential to make money from enterprise customers in India.

But once the startup showed consistent revenue, it got accepted. Now it looks every inch the YC company. In a move that looks straight out of the programme’s playbook, Bolna hiked its pricing and is now on track for $700,000 in ARR.

Another opportunity for Asian startups may be around stablecoins, an area that YC called out as an area of focus for its batches this year.

A more streamlined approach fits today’s investment climate, but it also marks a fundamental shift in how YC looks at global startup markets.

YC’s appeal in Asia was always reputational. Founders wanted to go there and, for a while, it wanted to back local startups that it believed could be foundational in markets like India and Indonesia. But it never had boots on the ground. In today’s AI focused investor world, it has no interest in those same local startups, unless they have global appeal.

Still, the firm’s India wins will go down as historic. It stands to make more than $1 billion from Meesho and Groww, validating a decade of backing promising founders from the region.

For Asian founders, the lesson is clear. YC can be valuable, but it will come at a cost. Now it is up to the local ecosystems to show that they are mature enough to stand alone.

YC got its exits. Now it’s moving on.