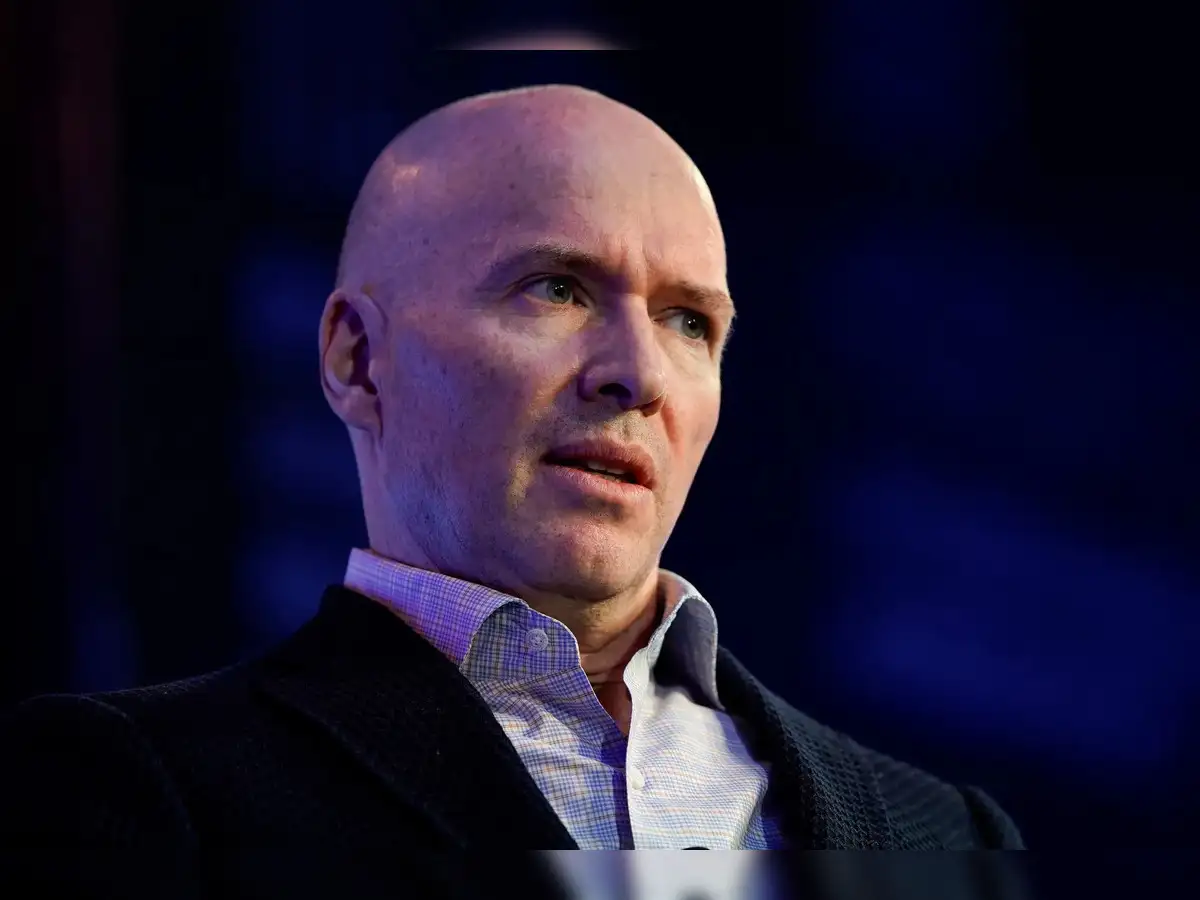

In an era of rapid capital deployment and surface-level conviction, few investors in Asia combine founder empathy with institutional discipline as consistently as Will Klippgen. As co-founder and now Partner Emeritus, at Cocoon Capital, Klippgen has spent more than two decades building and backing early-stage companies across Southeast Asia and India—often ahead of market consensus.

In a wide-ranging conversation with Indian Startup Times, Klippgen reflected on his journey from entrepreneur to angel investor to venture capitalist, offering clear-eyed perspectives on capital efficiency, founder behaviour, regulatory friction, and what it truly takes to build enduring companies in emerging markets.

From Entrepreneur to Angel Investor to VC

Klippgen’s entry into venture capital was neither hurried nor accidental. Before becoming an investor, he lived through the full emotional and operational volatility of entrepreneurship, having co-founded B2C shopping comparison portal Kelkoo.com in the early days of the internet. That experience continues to shape how he evaluates founders—not just their ideas.

As internet penetration accelerated across Southeast Asia in the mid-2000s, Klippgen began investing as an angel in Singapore. Rather than chasing volume, he focused on understanding why some founders adapted and survived while others stalled. That learning eventually led him and his partner Michael Blakey to formalise their common investment approach with the launch of Cocoon Capital in 2016.

From the outset, Cocoon’s philosophy was explicit: quality over quantity. The firm focuses on enterprise tech and deep-tech at the pre-seed and seed stages. Rather than spreading capital thin, Cocoon chooses deep involvement, long-term alignment, and disciplined pacing in no more than five companies a year. The past 9 years have proven that early engagement can dramatically change outcomes. Their second 2018 fund is among the top three performers of their vintage.

That conviction extended to incentive alignment. Klippgen and Blakey deliberately chose not to draw a salary during Cocoon Capital’s first five years, reinforcing a belief that venture capital only works when founders, investors, and LPs are aligned over the long term.

India: Scale, Opportunity, and the Reality of Failure

Reflecting on India, Klippgen acknowledged the sheer scale of the ecosystem. With nearly 14 lakh startups registered and increasing participation from Tier II and Tier III cities, India represents one of the most dynamic entrepreneurial environments globally—supported by increasingly pragmatic government initiatives.

Klippgen’s exposure to India includes both success and failure. An early investment in Ixigo, which listed in Mumbai in 2024, validated his conviction-led approach. At the same time, his experience with GoGoBus, which did not succeed, reinforced a fundamental reality of venture investing.

“Failure is not the exception in startups—it is the default,” Klippgen noted. “Unless founders actively fight entropy through customer learning, speed of iteration, and financial discipline, the odds are stacked against them.”

Convertible Instruments and Policy Bottlenecks

One of Klippgen’s sharper critiques concerned India’s somewhat unique regulatory stance on convertible instruments. He argued that restricting such structures introduces unnecessary rigidity at the earliest stages of company formation.

“When you ban flexible instruments like convertible notes, you don’t reduce risk—you just push founders into artificial pricing games,” he said. “That hurts early alignment, increases friction, and creates bigger problems later.”

From an investor perspective, these constraints slow capital deployment and distort risk-reward dynamics, ultimately impacting long-term ecosystem health.

Gaps in Southeast Asia’s Digital Economy

Turning to Southeast Asia, Klippgen highlighted persistent inefficiencies in core infrastructure—particularly finance and logistics. Despite widespread digitisation, foundational systems around payments, lending, and physical distribution remain fragmented and therefore, a massive entrepreneurial opportunity.

He cited Buymed, a Vietnam-based startup improving pharmaceutical distribution, as an example of how startups can create durable value by solving real infrastructure problems. Buymed allows pharmacies to order goods in their online app and provides authenticity, safety, and last-mile efficiency. This not only saves costs but benefits regulators, suppliers, and protects end customers simultaneously.

“The most scalable companies in emerging markets aren’t chasing novelty,” Klippgen observed. “They’re fixing what’s broken in a way that aligns incentives across the ecosystem.”

Founder Behaviour: What Separates the Successful from the Rest

Across geographies, Klippgen sees one defining trait separating successful founders from those who stall: adaptability.

“The founders who succeed aren’t necessarily the smartest in the room—they’re the fastest learners,” he said. “The moment a founder stops listening to customers, the clock starts ticking.”

At Cocoon Capital, this philosophy extends to how investment decisions are made. The firm prefers extended engagement with founders before investing, observing how they respond to feedback, uncertainty, and opposing viewpoints.

Klippgen also addressed a recurring misconception among deep-tech founders. “Deep tech founders often confuse technical difficulty with commercial value,” he said. “The market doesn’t care how hard something is to build—it cares whether it solves real problems and whether someone will pay a sufficiently high price for it.”

Capital Efficiency in a Tighter Funding Cycle

As global funding conditions tighten, Klippgen has observed a meaningful shift in founder behaviour. Capital efficiency, runway planning, and early profitability are no longer optional—they are survival skills.

At Cocoon, portfolio companies are encouraged to adjust spending and hiring at least six months before funding stress emerges, rather than reacting after liquidity becomes constrained.

“Easy money created bad habits,” Klippgen noted. “This cycle is forcing founders to relearn fundamentals—and that’s healthy. Discipline always outperforms excess in the long run.”

The Case for an Exit-Ready Mindset

One of Klippgen’s most pointed observations centred on exits. In emerging markets, many founders postpone thinking about liquidity far too long.

“If a founder has never seriously considered who might acquire the company and why, they’re not building a venture-backed business—they’re running an experiment,” he said.

He added that misalignment often arises when founders are emotionally resistant to exits, despite venture capital being structurally dependent on liquidity events.

Advice to Early-Stage Founders

For founders considering fundraising, Klippgen offered direct advice: do not raise capital unless you are confident the business solves a real problem and can eventually generate profit.

“Capital should accelerate clarity—not compensate for its absence,” he said. “When doubt exists, mentorship and honest feedback are often more valuable than premature funding.”

Conclusion: A Measured Shift in Focus

After nearly two decades in venture capital, Klippgen shared that he is becoming more selective with new investments. Rather than stepping away, he is focusing his time where he believes he can add the greatest leverage—through mentoring, portfolio support, and long-form thinking.

Having co-founded Cocoon Capital and now as Partner Emeritus, Will is no longer involved in the day-to-day operations, but he continues to be active in advising founders and supporting Cocoon Capital’s portfolio companies.

The conversation closed on a reflective note. Venture capital, much like entrepreneurship, is a long-distance pursuit shaped by patience, humility, and conviction. Klippgen’s journey—from founder to investor to mentor—underscores a simple truth: enduring value is built not by speed alone, but by discipline, trust, and an unrelenting focus on real problems.

-Interview conducted by Sandhya Bharti