Sign up here.

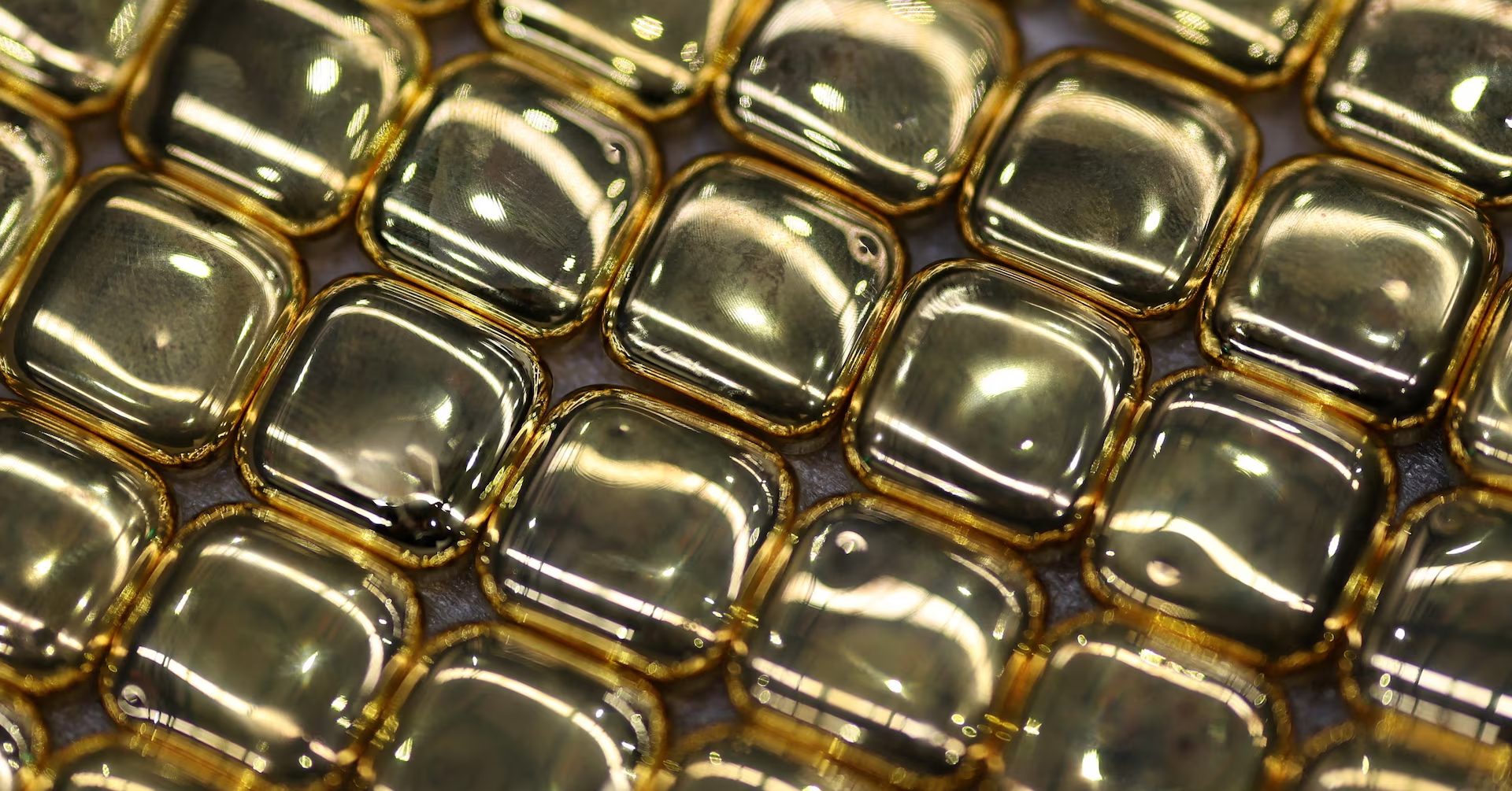

“You look at gold prices and they are just screaming that markets are concerned about geopolitical risk,” Matthew Miskin, co-chief investment strategist at Manulife John Hancock Investments, said of the most recent rise in bullion.

Non-yielding gold is traditionally seen as a safe haven for investors during wider market uncertainty or volatility.

GLOBAL ORDER IN QUESTION?

If the U.S. forcibly took Greenland from fellow NATO member Denmark, it would likely not only mark the end of the military alliance but the wider balance of power, analysts say.

“It would call into question much more the global order that’s essentially largely been established since Bretton Woods II, (or) the end of World War Two, when NATO was created,” said Steve Kolano, CIO at Integrated Partners.

If Europe must rely less on the U.S. for its defence, it is no surprise that investors are buying European defence stocks, a sector that’s more than tripled since Russia’s 2022 invasion of Ukraine.

“With the rhetoric about Greenland, the rally is being sustained,” said Jeremie Peloso, chief European strategist at BCA Research.

POLITICAL RISK HARD TO PRICE

Beyond buying gold and defence stocks, other trades are more difficult for investors to pick.

“Political (and) geopolitical risk is very hard to price and markets typically do a very poor job of it, given that these are big-impact, but low-probability events,” said Idanna Appio, portfolio manager at First Eagle Investments, who does own some gold as a hedge against geopolitics.

“If you’re positioning your portfolio for something that has a 1%, 5% chance of being realized, then you’re already sort of saying: ‘well, 95% of the time I’m going to be wrong.'”

That helps explain why there has been little broader impact, with world stocks at near record highs and Danish government bonds rallying alongside European peers.

Denmark’s closely managed crown currency has been weakening, but rate differentials are a major factor and it is still close to the central rate at which it is pegged to the euro .

WHERE’S SAFETY?

Traders reacted immediately when Moscow acted on its Ukraine threats, sparking major moves in oil, the euro and stocks.

“If the U.S. were to seize Greenland by force, or maybe not by force, but under some sort of coercion, … you would have a rally towards Treasuries, you’d have a selloff in European government bonds, which quality investors wouldn’t see as a haven,” said Natixis’ head U.S. economist Christopher Hodge.

Investors reckon that short-term, the dollar and Treasuries would benefit from a rush to safety.

It is too soon to see any signs of that shifting on the back of the U.S. action in Venezuela or its Greenland threats, with some saying it could prompt money to move out of the U.S.

“I remain nervous that actions that are seen as the U.S. breaking the rules of the road, could lead to shifts in asset allocation, bringing money back to Europe, back to Asia,” said First Eagle’s Appio.

Reporting by Alun John and Karin Strohecker in London, and Laura Matthews, Lewis Krauskopf and Saqib Iqbal Ahmed, in New York, Editing by Dhara Ranasinghe, Elisa Martinuzzi and Alexander Smith

Our Standards: The Thomson Reuters Trust Principles.