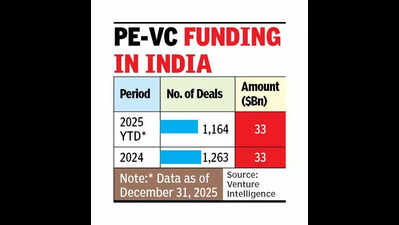

Chennai: Investments in India’s private equity–venture capital (PE-VC) segment remained flat at $33 billion in CY2025. A total of 1,164 deals were recorded during the year, around 100 fewer than the 1,263 deals in CY2024. PE-VC investments had also stood at $33 billion in CY2024. The figures exclude investments in the real estate sector.Data released by research firm Venture Intelligence on Wednesday showed that IT & ITeS companies accounted for $13.1 billion of the total PE-VC investment pie in 2025, an increase of 15% when compared with 2024 at $11.4 billion. The BFSI sector attracted $5.4 billion during 2025, a growth of 23% over $4.4 billion raised in the previous year (2024).

On a quarterly basis in CY2025, Q4 (Oct–Dec) recorded the second-highest PE-VC investments at $9.9 billion, while Q1 (Jan–Mar) topped the chart with investments of $10.2 billion. Late-stage companies that are more than 10 years old attracted the largest share of investments at $10.8 billion, followed by institutional investments in growth-stage firms—companies aged five to 10 years, irrespective of round or series—at about $7.4 billion.Arun Natarajan, founder, Venture Intelligence, said, despite significant headwinds in the form of the Trump tariffs and various international developments, PE-VC investments have ended 2025 remarkably flat compared to the previous year. The continued opportunities for growth in the domestic economy as well as the robust IPO markets, have provided sufficient confidence to investors, he added.“In the last quarter (Q4 2025), PE-VC investors have taken the mid-year shock delivered by the Trump tariffs in their stride and have shown keenness to make significant bets in domestic economy-focused companies in BFSI, manufacturing, e-commerce and retail,” he told TOI.To a query on the forecast for CY2026, he said, “Provided the international environment does not throw new curve balls, the stable PE-VC figures of the past two years offer a good base to grow from with catalysts in the form of good exits and the IT and GST reforms unveiled by the Union government in 2025.”