Programming note: ETtech Morning Dispatch will return with a new edition on January 5, 2026. Happy holidays & best wishes for 2026 from the ETtech team.

As VC exits pile up, 2026 will test fundraising prospects of independent funds

India’s venture capital churn is setting up a real test for first-time fund managers in 2026, at a time when departures from large firms are coinciding with limited partners (LPs) becoming more selective.

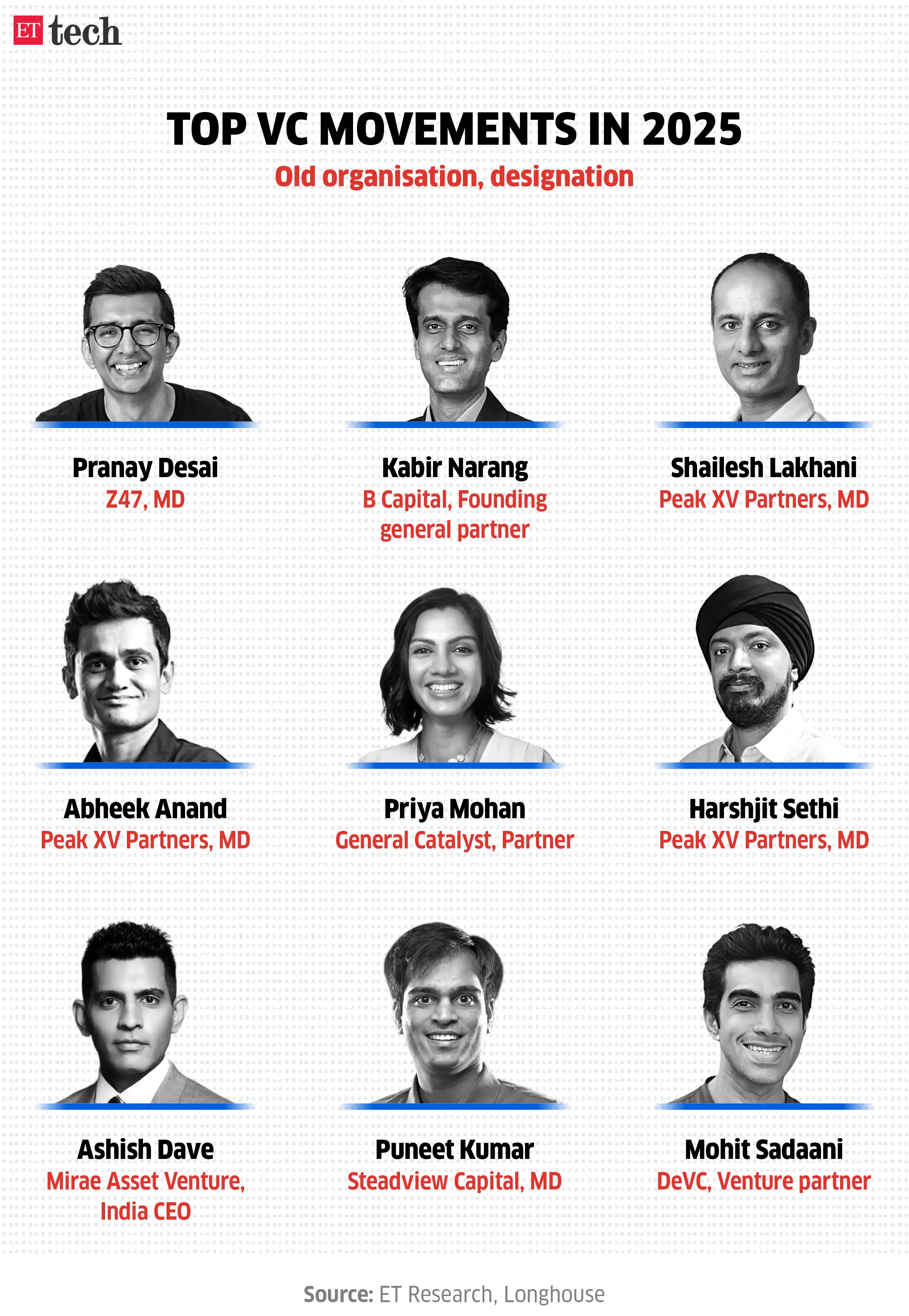

What’s happening: Nearly two dozen senior investors moved roles or exited firms in 2025, according to Longhouse. Recent departures include Z47’s Pranay Desai and DeVC’s venture partner Mohit Sadaani, alongside exits at Peak XV, Mirae Asset Venture, Steadview, and General Catalyst.

Why it matters: Track record alone may not be enough. LPs are increasingly selective, with limited appetite for backing first-time managers at scale. “For everyone else, the LP market just doesn’t have the depth yet,” said an investor at an India-focussed fund.

The fund funda: It’s harder to make large VC funds work as big bang IPO outcomes thin out and private equity dominates large exits. That is pushing partners to consider smaller $50-100 million vehicles with sharper focus.

What next: Expect more spin-outs, niche strategies, and smaller debut funds backed by entrepreneurs and family offices. Institutional capital will likely follow only after proof, not promise, bankers and investors said.

Also Read: Indian VCs go independent amid wider churn in early-stage investing

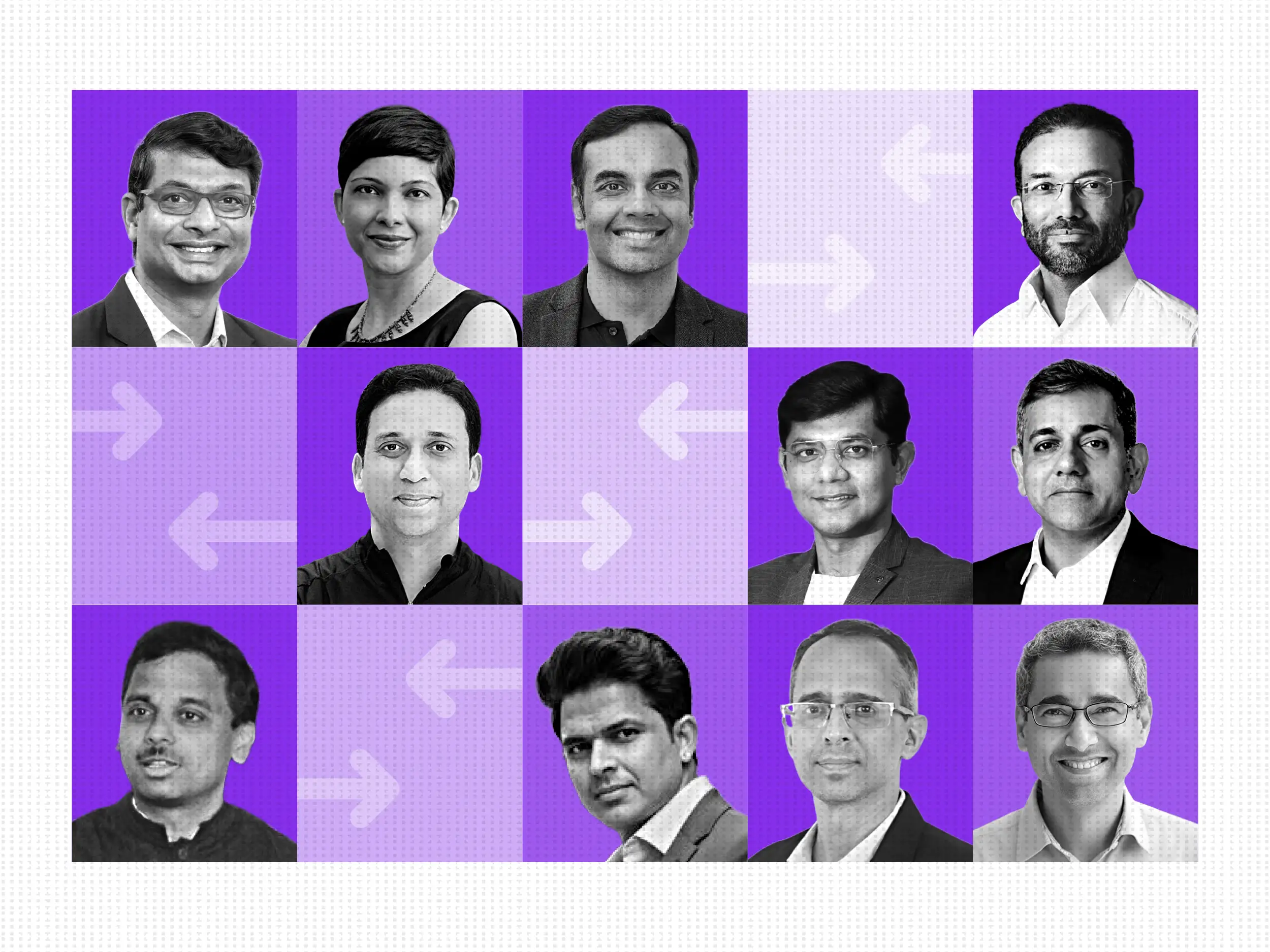

Who’s in, who’s out: The biggest executive moves in India’s tech & startup sector

India’s startup and tech ecosystem saw sustained churn at the top this year, with more than a dozen chief executives across ecommerce, fintech and marketplaces stepping into new roles, according to data shared exclusively by staffing firm Longhouse Consulting.

Growth push: The leadership reshuffle reflects business restructuring and a renewed push for scale, amid buoyant public markets for new-age companies and sharper scrutiny of execution.

IPO effect: Increasing stock market listings have pushed boards to bring in seasoned operators to tighten governance and leadership, Anshuman Das, chief executive of Longhouse Consulting, told us.

Also Read: 2025 Year in Review: Meet top free agents of startups and tech

ETtech Explainer: How the December 31 riders’ strike could hit qcomm & food delivery

The quick commerce and food delivery workforce is set to go on another all-India strike on December 31, one of the busiest days for these sectors. The planned strike by about 100,000-150,000 riders could impact this, causing operational disruptions, said experts.

But first, why are the riders conducting these strikes?

Driving the news: The gig workers union had called for two strikes — on December 25 and 31 — demanding job security, higher pay, safer working conditions, and social security benefits.

The impact:

- On Christmas, about 40,000 riders across the country conducted flash strikes and bike rallies, which led to 50-60% of orders being delayed.

- About 100,000-150,000 riders will join the strike on December 31.

- The strikes may majorly impact select south-Indian cities, resulting in a 10-20% fall in order volumes, per experts.

Also Read: Quick commerce platforms drum up sales, push deals ahead of New Year’s Eve to offset delivery strike & rush

Tell me more:

- Platforms are preparing for new year’s eve by revamping their apps with party-themed sections and targeted deals on soft drinks, snacks, mixers, disposable cups, decoration items and games.

- Food delivery apps Zomato, Swiggy, and quick commerce platforms Zepto, Blinkit, and Instamart are pushing customers to stock up ahead of new year’s eve.

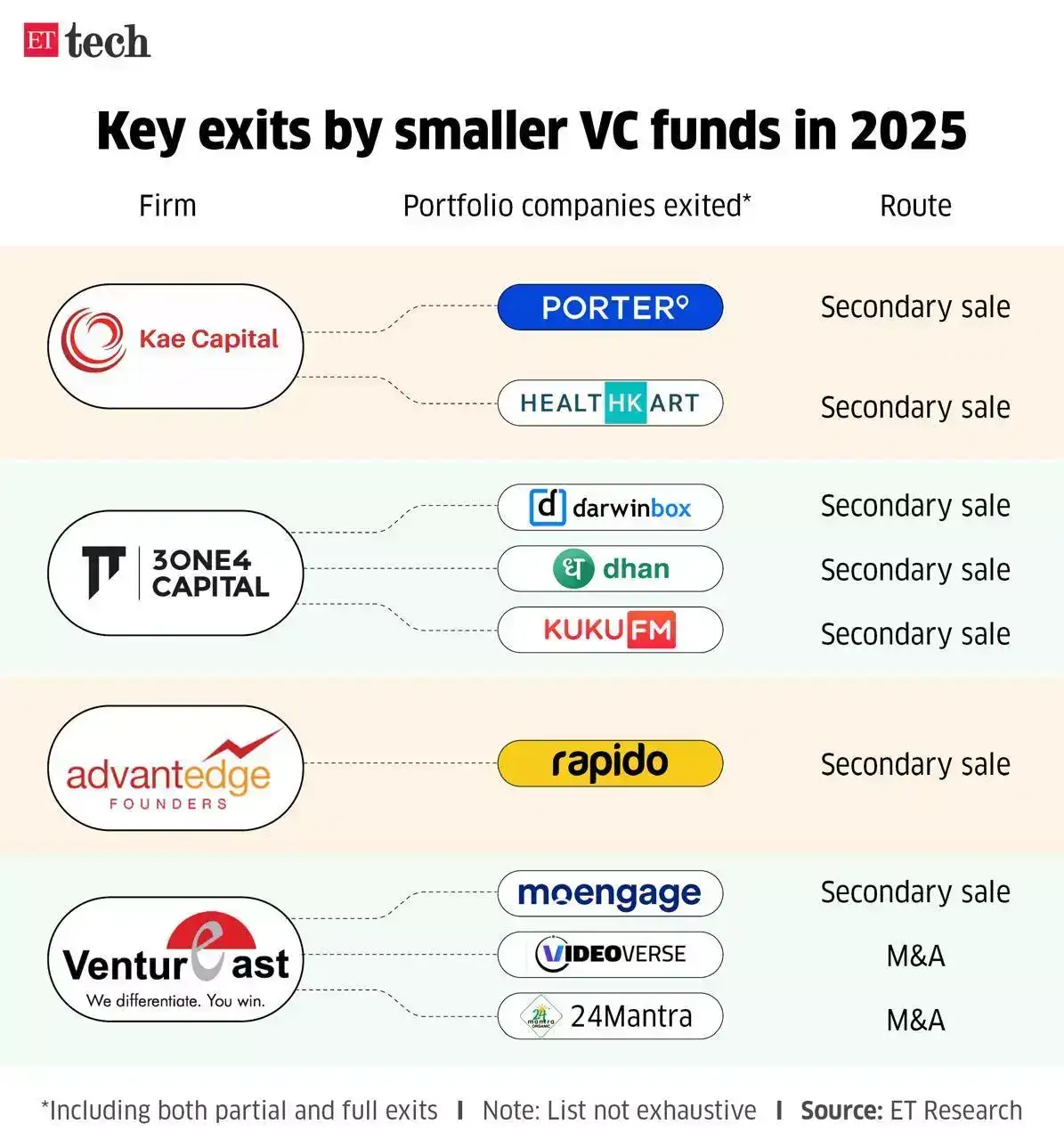

Year in Review: Seed investors reap bumper harvest on exits

Blockbuster listings such as Lenskart and Meesho, along with eye-catching secondary transactions, may have dominated the headlines this year. But away from the spotlight, India’s early-stage investors quietly locked in some of their biggest paydays yet.

Raking in capital: India-focussed seed and early-stage funds are emerging as some of the year’s biggest winners, benefiting from both IPO momentum and a maturing secondary market.

- Kae Capital has logged more than 2X returns on its $25 million investment in logistics startup Porter.

- Mobility-focused fund AdvantEdge clocked 30X returns through a partial sale of its Rapido stake to Prosus. The fund first backed Rapido in 2016.

- VenturEast secured 10X returns on its investment in the customer engagement SaaS firm MoEngage through a secondary deal.

Also Read: Startup funding flat in 2025 on early-stage AI reset

Here’s a comprehensive roundup of ETtech’s ‘Year in Review’ coverage:

Other Top Stories By Our Reporters

India’s IT shift: India’s $283-billion Information Technology (IT) services market would undergo a significant upheaval in 2026, experts said, as businesses increase their investments in cloud, artificial intelligence, and digital modernisation to mark a change in both the textures of tech spending and delivery patterns.

Mamaearth founder Varun Alagh buys 0.6% stake in company: Varun Alagh, founder and chief executive of Mamaearth parent Honasa Consumer, on Monday bought a 0.6% stake in the company for Rs 50 crore, according to a stock exchange filing.

Ather Energy allots 4.3 lakh shares under Esop plan: Ather Energy has allotted 433,842 equity shares to employees following the exercise of stock options. The Bengaluru-based company’s board approved the allotment through a resolution passed on December 29.

Global Picks We Are Reading

■ The new surveillance state is you (Wired)

■ AI start-ups amass record $150 billion funding cushion as bubble fears mount (FT)

■ Innovative ways the world used AI in 2025 (Rest of World)