In July 2025, Pat Gelsinger, former Intel chief executive officer, called for a US sovereign wealth fund to keep America’s technological edge. Just a month in, a US SWF materialised under Donald Trump’s administration, owning 10% of Intel Corporation – the only American company manufacturing advanced chips on US soil.

A few months later, the Trump administration announced a plan to take equity stake in the former Intel CEO’s Chip startup XLight, which in return would receive up to $150m to develop ultraprecise lasers for squeezing more circuits onto semiconductors. (Most likely, the US government would become xLight’s largest shareholder, according to the Wall Street Journal report).

The startup’s plan is audacious. XLight plans to build massive ‘free electron lasers’ powered by a particle accelerator to create a more powerful and precise light source for use in semiconductor chip fabrication plants. The most-advanced lasers used by ASML, the current industry leader, produce extreme ultraviolet light at a wavelength of around 13.5 nanometres. XLight’s lasers are targeting much more precise wavelengths, of down to 2nm.

New global trend

The xLight investment shows that the US SWF under the Trump administration is enthusiastic about early investments into tech startups. The US SWF is joining a global trend of sovereign investment funds becoming new, powerful venture capitalists, actively scouting startups themselves, investing earlier and even creating their own standalone VC arms, such as Taiwania Capital, bankrolled by Taiwanʼs SWF.

The UK government launched its £500m Sovereign AI Unit in July 2025 to build and scale domestic AI capabilities. In 2024, MGX, the newly established tech investing company affiliated with the United Arab Emirates’ SWF Mubadala, joined OpenAI’s mega funding round of $6.6bn as a major investor.

Not to be outdone, Saudi Arabia’s trillion-dollar sovereign fund Public Investment Fund in 2025 formed Humain, its AI-focused operating subsidiary to invest in and deliver AI-native platforms across four core layers: infrastructure, cloud, data and models, and applications. At the end of 2025, Qatar set up national AI firm Qai under its SWF QIA (an investor in Anthropic), joining its Gulf neighbours in the global AI race.

The SWFs’ ample resources, preference for lower profile and long time horizons make them the perfect shareholders and strategic partners for tech startup founders. In the case of xLight, the $150m investment will help the laser venture meet its goal of producing its first silicon wafers by 2028, Gelsinger said. But that does not sway the US government’s investment risk appetite.

‘This partnership would back a technology that can fundamentally rewrite the limits of chipmaking,’ Commerce Secretary Howard Lutnick said in the press release. This underscores that the long-term capital of SWFs can bridge the important financing gap between research breakthroughs (‘a proof of concept’) and scalable technologies (‘commercial production’).

Focus on hardware over software

Another remarkable aspect of the xLight case is that it is an investment in AI hardware – or advanced manufacturing, in a broader context. In contrast, Silicon Valley mostly chases software startups, not the high-barrier, capital-intensive ‘hard tech’ innovation.

Roughly 90% of US venture capital today flows into software – an investment pattern optimised for nimble businesses and quick returns, but not strategic for national power, according to analysis by the Institute for Security and Technology. As such, the US SWF also fills the hardware gap in the VC capital market.

Probably it’s no coincidence that, across the Pacific, Chinese SWFs are also focusing on AI hardware startups. In early 2025 Beijing launched a Rmb60.1bn ($8.4bn) national AI fund, whose main shareholder is the National Integrated Circuit Industry Investment Fund III (the ‘Semiconductor Chip Fund’), which is backed by China’s Ministry of Finance and other state-owned enterprises, according to CNBC reports.

Official releases of the AI fund have said that one of its main focuses will be ‘embodied AI’. Just like the mobile internet revolution last decade, in the AI age the US leads in fundamental research, but China excels at applying tech – especially AI hardware such as intelligent robotics and other physical AI devices, where the ‘made in China’ manufacturing capabilities are a unique advantage.

Bridging the financing gap

Overall, global SWFs are the ‘unicorn-makers’ behind the scenes. Their tech investments are on par with private equity and venture capital funds, but often with a strategic objective on top of financial returns. That’s why they are especially suited for investing in high-risk, capital-intensive and long-horizon tech ventures, who often struggle to raise capital.

Therefore, the US SWF may provide important capital to bridge the financing gap in the tech venture world. It’s emerging as the financier for the hard tech startups, whose technologies are vital to national competitiveness, but whose risk, scale and time dissuade private investment.

As such, it will not be a surprise if the US SWF were to become a leading investor in the burgeoning quantum computing field. Quantum computing firms including IonQ, Rigetti Computing and D-Wave Quantum are in talks to give the US government equity stakes in exchange for federal funding (minimum funding of $10m each), The Wall Street Journal reported in October 2025.

Quantum computers are seen as a critical next-generation technology, but it’s still an emerging technology facing big hurdles. Before quantum computing is fully proven for widespread use, the US SWF could serve as a patient, long-term venture partner for the researcher-founders.

Winston Ma is Executive Director of the Global Public Investment Forum and Adjunct Professor at NYU School of Law. He is the author of The Hunt for Unicorns: How Sovereign Funds are Reshaping Investment in the Digital Economy.

This is the third article in a series exploring this topic. Read parts one and two here.

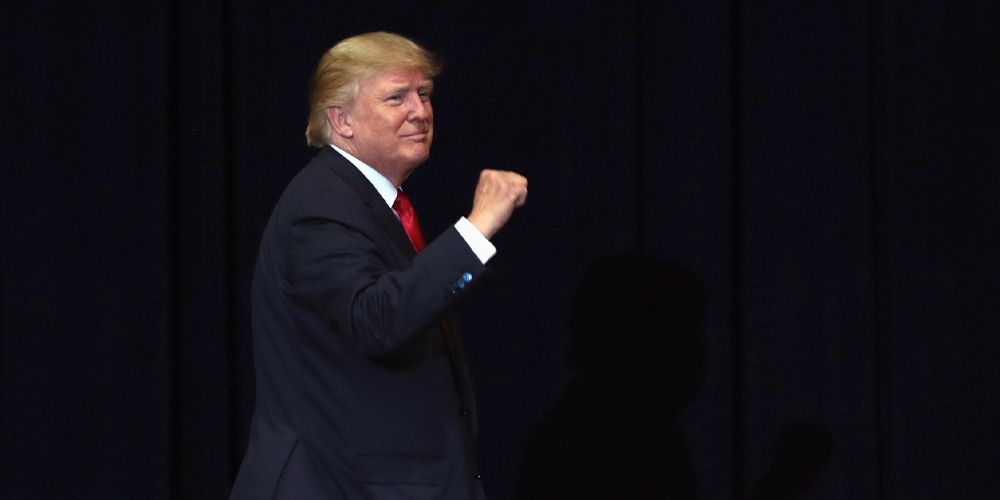

Image credit: Gage Skidmore

Interested in this topic? Subscribe to OMFIF’s newsletter for more.